|

|

|

|

|

|

By Marek Grzybowski

About 2.16 billion tonnes of crude oil were pumped through marine fuel terminals, of which the European Union’s marine terminals reloaded over 470 million tonnes in 2023. This result was surpassed by the economy of the People’s Republic of China, which imported 512 million tons by sea in the period January-December 2023, says Banchero Costa in the latest report. The Port of Gdansk is among the leading EU ports transshipping crude oil.

The war in Ukraine and disruption in supply chains made it another good year for oil trading companies. Demand for this energy raw material has increased despite high oil prices and the economic recession in many markets.

Despite the slowdown in many industrial and consumer markets, in the period January-December 2023, global transport of crude oil by sea increased by 5.3% y/y and reached 2,160.6 million tonnes, according to information based on data from observations of tanker traffic conducted by Refinitiv Maritime, excluding all cabotage trade.

In earlier years, global seaborne crude oil shipments were lower. In the period January-December 2022, they exceeded 2,050.9 million tons, and in 2021, 1,886.3 million tons were loaded onto tankers, while in 2019, 2,110.5 million tons were transported by sea between fuel terminals.

Persian Gulf – over 40% of global supplies

The dominant region and source of supplies is the Persian Gulf region. In the period January-December 2023, supplies from oil fields located in this region decreased by 1.4%. y/y to 869.1 million tons. Arab oil is still the dominant source of supply for many recipients, and recently also for Poland. Supplies from the Persian Gulf accounted for 40.2% of global maritime oil trade in 2023.

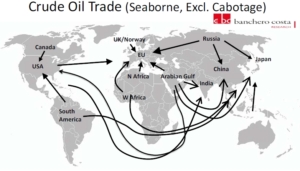

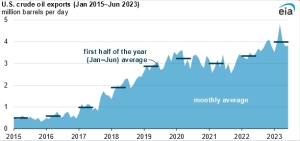

Exports from Russian ports increased in 2023 by 5% y/y to 229.5 million tons. This is 10.6% of the supply in global crude oil trade. From the USA, exports of this raw material increased by 19.5% y/y to 197.2 million tons. From West Africa, oil exports last year increased by 2.5% y/y and reached 174.8 million tons. Exports from South America increased by 20.8% y/y. and 157.6 million tons were loaded onto tankers. Exports from the oil fields of Northwest Europe increased by 3.4% y/y to 111 million tons.

China’s economy generated demand for 23.7% of global supplies

The largest maritime importer of crude oil in 2023 was the PRC. China’s economy generated demand for 23.7% of global supplies. Oil supplies to China increased in the period January-December 2023 by 16.6% y/y to 512 million tons, while a year earlier it was over 70 million tons less (439.9 million tons in 2022).

India’s imports increased by 1.9% y/y to 228.2 million tonnes. This means that India generates 10.6% of global demand. The South Korean economy imported +2.7% more in 2023 than the previous year. Fuel terminals pumped 140.4 million tons of crude oil from tankers. Japan reduced imports by 8.1% y/y. 121.6 million tons of crude oil were unloaded at the fuel terminals of Japanese ports.

The European Union is the second global importer

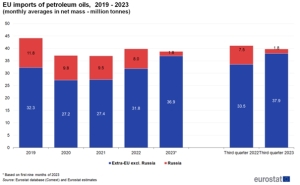

The European Union is the world’s second largest importer of crude oil by sea. In 2022, it overtook China. However, in the period January-December 2023, imports by sea to the European Union (27) increased at a rate four times lower than imports from China. It was only 4.7% y/y. As a result, tankers delivered 472.4 million tonnes to fuel ports in the EU. In 2023, the EU accounted for 21.9% of global crude oil trade.

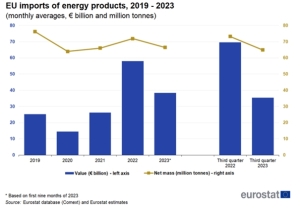

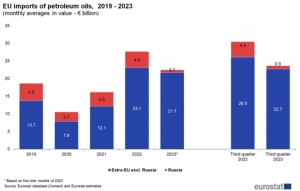

EUROSTAT points out that “the observed significant fluctuations in EU oil imports [Ministry of Economy] are a consequence of high price volatility. The share of crude oil [in value terms – Ministry of Economy] in total EU imports increased from 9.1% in 2021 to 11% in 2022 and decreased slightly to 10.6% in the first three quarters of 2023.

EU countries, including Poland, increased their imports of crude oil. In 2022, the economies of EU countries imported 388.8 million tons, a year earlier it was over 402.5 million tons, while in 2019 the EU needed 446 million tons of oil imported through fuel terminals.

Increased spending on oil imports

These volumes also translated into an increase in spending on crude oil imports. The average monthly import from Russia decreased in 2021-2022, but due to rising prices, the value of imports from Russia also increased (EUR 0.6 billion). Imports from other non-EU partners increased, which meant that EUR 10.9 billion more had to be paid for supplies, according to EUROSTAT. – In the first three quarters of 2023, the trend was reversed, and the total average values decreased by 19% compared to 2022 (from EUR 27.6 billion in 2022 to EUR 22.4 billion in Q1-Q3 2023 y.) – says EUROSTAT.

About 14% of the crude oil delivered to the EU by tankers in 2023 was transported on VLCCs, about 43% arrived on Suezmax tankers and about 42% was offloaded from Aframax ships, reports Banchero Costa Research.

Rotterdam was the port with the largest volume of received oil delivered to the EU. In 2023, 101 million tons of crude oil reached the refineries located in its zone by sea. In second place was the Northern Port in Gdańsk, whose terminals pumped 37.6 million tons (in 2022 – 25.5 million tons).

– Naftoport has become an oil hub for the region. It is through the Gdańsk fuel terminal that the refining needs of both Poland and our closest neighbors are secured. Naftoport last year reloaded a total of 36.6 million tons of crude oil and fuels. Part of this cargo is supplies to German refineries. After cutting off supplies via the “Przyjaźń” oil pipeline from Russia, Poland became the most important gateway for them, informed the Port of Gdansk Authority.

In third place is the seaport of Trieste, to which tankers delivered 36 million tons. Next are the fuel terminals in Fos (22.0 million tons), Le Havre (19.3 million tons), and Wilhelmshaven (17.9 million tons). The following ports handled less than 15 million tons in 2023: Cartagena (14.3 million tons), Sarroch (12.2 million tons), Augusta (11.4 million tons), Algeciras (10.2 million tons), Tarragona (9, 8 million tons), Lysekil (9.5 million tons).

Turbulences in crude oil logistics

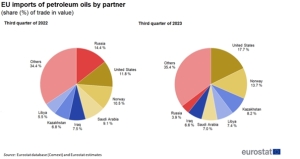

European Union countries have been hit hard by the turmoil in crude oil logistics. Ship deliveries had to replace pipeline transport. It was necessary to change the countries and ports from which oil was imported in 2023. Not everything went as expected and holes appeared in the sanctions through which oil from Russia leaked.

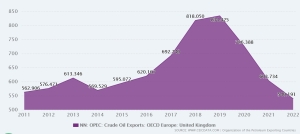

However, changes in logistics chains have changed transshipment in many countries and ports, both on the export and import side. In the period January-December 2023, supply from Russian ports (including Kazakh oil) decreased by 40.4% y/y compared to 2022 and 47.9% compared to 2021 compared to 2021. In 2023 58.6 million tons were exported through Russian terminals, while in the previous year it was 98.4 million tons, and in 2021 112.5 million tons.

Ukrainian drone attack on the ports of St. Petersburg and Ust Luga caused the Governor of the Leningrad Oblast, Aleksandr Drozdenko, to announce an alarm for ports in January and introduce the highest level of threat to critical infrastructure facilities. The alarm was announced in all areas of the oblast. In particular, it applies to terminals with installations located in the ports of Vyborg, Vysotsk and Primorsk.

Currently, Novorossiysk is the largest port exporting crude oil to the EU. In 2023, it amounted to 47.4 million tons. Russian ports have dropped in the ranking of oil suppliers to the EU over the last 2 years. However, they are the fourth supplier of crude oil to the EU transported by sea.

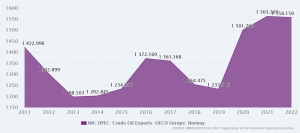

USA, Norway and Great Britain in the oil gap after sanctions

This is only 12.4% of the volume in the period January-December 2023. British and Norwegian oil from the North Sea accounted for last year. 18.6% of deliveries to the EU. Production companies from North Africa provide 17.3% of supplies, and 15.4% of the oil imported by EU countries arrives from the USA via tankers.

As a result of the sanctions imposed on Russian oil, supplies to the EU from the North Sea (Norway and Great Britain) increased by 14% year on year. In the period January-December 2023, 87.8 million tonnes arrived by tankers from British and Norwegian offshore drilling to EU ports.

Imports from North Africa (including Sidi Kerir) increased by 17.3% y/y to 81.7 million tonnes in January-December 2023. Imports from the US increased by 41.5% y/y, reaching a new record all-time amounting to 72.8 million tons.

Supplies from West Africa to Europe increased by 8.2% y/y to 54.4 million tonnes in 2023. Direct supplies from the Persian Gulf also increased sharply. In 2023, the supply dynamics reached 32.2% y/y to 45.3 million tons. The volume of deliveries from Turkey (Ceyhan) decreased by 32.7% y/y to 23 million tons from 34.2 million tons in January-December 2022.

The sanctions imposed on Russia have resulted in a significant decrease in direct imports of Russian oil to the European Union. Now the country’s oil comes indirectly through operators and traders using “gray” or “black” fleets.

Transfer ports are also cleverly used, where oil from ships carrying Russian oil is transferred to ships operating on official registers. STS operations – pumping oil in bays or in port roadsteads – are also common.

Russian oil also reaches EU ports in the form of products produced in refineries of third countries that have not imposed sanctions. And so, thanks to leaking sanctions, oil from Russia reaches European Union ports.

This year’s research reveals some hard-fought gains at the top, with women’s representation in the C-suite at the highest it has ever been. However, with lagging progress in the middle of the pipeline—and a persistent underrepresentation of women of color1—true parity remains painfully out of reach.

The survey debunks four myths about women’s workplace experiences and career advancement. A few of these myths cover old ground, but given the notable lack of progress, they warrant repeating. These include women’s career ambitions, the greatest barrier to their ascent to senior leadership, the effect and extent of microaggressions in the workplace, and women’s appetite for flexible work. We hope highlighting these myths will help companies find a path forward that casts aside outdated thinking once and for all and accelerates progress for women.

The rest of this article summarizes the main findings from the Women in the Workplace 2023 report and provides clear solutions that organizations can implement to make meaningful progress toward gender equality.

Over the past nine years, women—and especially women of color—have remained underrepresented across the corporate pipeline (Exhibit 1). However, we see a growing bright spot in senior leadership. Since 2015, the number of women in the C-suite has increased from 17 to 28 percent, and the representation of women at the vice president and senior vice president levels has also improved significantly.

These hard-earned gains are encouraging yet fragile: slow progress for women at the manager and director levels—representation has grown only three and four percentage points, respectively—creates a weak middle in the pipeline for employees who represent the vast majority of women in corporate America. And the “Great Breakup” trend we discovered in last year’s survey continues for women at the director level, the group next in line for senior-leadership positions. That is, director-level women are leaving at a higher rate than in past years—and at a notably higher rate than men at the same level. As a result of these two dynamics, there are fewer women in line for top positions.

Moreover, progress for women of color is lagging behind their peers’ progress. At nearly every step in the pipeline, the representation of women of color falls relative to White women and men of the same race and ethnicity. Until companies address this inequity head-on, women of color will remain severely underrepresented in leadership positions—and mostly absent from the C-suite.

As generative AI (GenAI) and other disruptive technologies rapidly transform the business landscape, companies are recognizing the strategic imperative of workforce reskilling. Indeed, according to a 2023 BCG survey, 75% plan to make significant investments in talent retention and development. Yet historically, even significant investments in upskilling programs often yielded disappointing results. One key reason is that companies haven’t found a reliable way to measure their programs’ impact, despite many attempts to create such mechanisms over the past 50 years.

Through our work with clients, we have developed a three-step approach to help companies better measure “return on learning investment” for some dimensions of organizational upskilling programs. ROLI enables companies to: 1) identify upfront the business outcomes or impact they are looking to achieve; 2) define the metrics they will use to hold the program accountable to that impact and measure progress; and 3) determine whether that impact has been achieved.

With these ROLI principles in mind, companies can design upskilling programs with demonstrable impact on revenues, costs, customer satisfaction, and innovation speed, ultimately improving margins and delivering on other business objectives.

It’s not hard to see why companies traditionally have had limited success measuring the impact of their upskilling programs. First, the measurement mechanism itself is very difficult. It’s one thing to track the time an employee spends in an upskilling program. But tracking them through their workflow to determine how they’ve applied their new skill sets is another thing altogether.

Even if it were possible to determine that a person’s performance had improved since the upskilling program, it’s not easy to distinguish correlation from causation. Since controlled studies aren’t realistic, it’s hard to know whether an upskilling program was responsible for the change or if other factors, such as motivation, manager input, or market dynamics played a role.

Another issue is that the impact of any single upskilling program isn’t typically immediately apparent. That’s because the upskilling cycle takes time—both acquiring the skills and then putting them to work in a way that has a business impact. And because leaders have different motivations for investing in upskilling, there isn’t a universally recognized measure of success or even an approach for tracking impact. Some leaders look for productivity improvements, others look for better retention, and still others look to boost their brand.

Despite these challenges, organizations that make a clear connection between the skills being learned and specific KPIs can measure the impact of upskilling programs on their own employees; the maturity of the ecosystem (how fast the organization can upskill and adapt compared with its competitors); and business performance.

While all three are undeniably important, the business impact is paramount, given the substantial investment needed to build scaling capabilities. For example, an upskilling program to facilitate a digital transformation in a global company can require an investment of millions of dollars. Only programs that will arguably unlock meaningful value for employees and the enterprise will get the green light.

More: BCG

Najnowsza edycja badania Deloitte Central European (CE) Private Equity (PE) Confidence Survey firmy doradczej Deloitte wskazuje, że prywatni inwestorzy z Europy Środkowo-Wschodniej z optymizmem patrzą w najbliższą przyszłość. 49 proc. przedstawicieli funduszy private equity spodziewa się wzrostu liczby przeprowadzonych transakcji. Chociaż poprawa nastrojów jest obserwowana od ponad roku, to jednocześnie inwestorzy zdają się zachowywać ostrożność w swoich prognozach. Na znaczeniu nadal zyskują kwestie ESG, które w swoich strategiach inwestycyjnych uwzględnia ponad połowa ankietowanych.

Opracowywany od ponad 20 lat indeks Central Europe PE Confidence Survey stanowi odzwierciedlenie nastrojów lokalnych uczestników rynku private equity. Na koniec 2023 r. jego wartość wyniosła 107 punktów, o 24 więcej niż sześć miesięcy wcześniej. Autorzy raportu zwracają uwagę na stały wzrost optymizmu przez trzy ostatnie badane okresy, co jest trzecim takim przypadkiem w historii badania. Jednocześnie zaobserwowana zmiana ma mniej dynamiczny charakter niż w poprzednich latach, a to, zdaniem ekspertów, świadczy o ostrożnym podejściu inwestorów do poprawiających się warunków rynkowych. Mimo to aż 86 proc. ankietowanych uważa, że najbliższe 12 miesięcy będą dobrym czasem dla działalności inwestycyjnej. W 2024 roku blisko połowa ankietowanych planuje skupić się na nowych inwestycjach. To niemal 10 pkt proc. więcej niż rok wcześniej. Co trzeci zamierza poświęcić się głównie zarządzaniu dotychczasowym portfelem spółek, a jedynie 15 proc. na pozyskiwaniu funduszy.

Chociaż najnowszy odczyt wskaźnika nastrojów jest najwyższy od półtora roku, to widać, że przedstawiciele środkowoeuropejskiego rynku private equity cechują się większą rozważnością niż w przeszłości. Jest to rezultat doświadczeń płynących z ponad dwudziestoletniego funkcjonowania w zmiennych warunkach rynkowych. Jednocześnie oczekujemy, że mimo wielu wyzwań gospodarczych aktywność prywatnych inwestorów w Europie Środkowo-Wschodniej powinna rosnąć. Dotyczy to zarówno strony popytowej, jak i podażowej, o czym świadczy odsetek ponad 40 proc. badanych kontynuujących proces sprzedaży mimo zmiennej sytuacji rynkowej – mówi Arkadiusz Strasz, partner w dziale doradztwa finansowego w Deloitte, M&A Transaction Services.

Chociaż najnowszy odczyt wskaźnika nastrojów jest najwyższy od półtora roku, to widać, że przedstawiciele środkowoeuropejskiego rynku private equity cechują się większą rozważnością niż w przeszłości. Jest to rezultat doświadczeń płynących z ponad dwudziestoletniego funkcjonowania w zmiennych warunkach rynkowych. Jednocześnie oczekujemy, że mimo wielu wyzwań gospodarczych aktywność prywatnych inwestorów w Europie Środkowo-Wschodniej powinna rosnąć. Dotyczy to zarówno strony popytowej, jak i podażowej, o czym świadczy odsetek ponad 40 proc. badanych kontynuujących proces sprzedaży mimo zmiennej sytuacji rynkowej – mówi Arkadiusz Strasz, partner w dziale doradztwa finansowego w Deloitte, M&A Transaction Services.Rozkład odpowiedzi dotyczących oczekiwań w stosunku do warunków gospodarczych potwierdza tezę o rosnącym optymizmie inwestorów. 42 proc. ankietowanych stwierdziło bowiem, że spodziewa się poprawy sytuacji rynkowej. To blisko trzykrotnie więcej w porównaniu do poprzedniej edycji badania. Jednocześnie o połowę spadł odsetek zakładających negatywny scenariusz. Ponad dwukrotny wzrost widać także wśród oczekujących wzrostu dostępności finansowania dłużnego. Tego typu odpowiedzi udzieliło 29 proc. badanych.

Na pytanie dotyczące aktywności rynkowej – przewidywanej liczby transakcji w 2024 roku, 49 proc. respondentów stwierdziło, że spodziewa się większej aktywności w tym obszarze. To niemal dwa razy więcej w porównaniu do połowy 2023 r. Wynik ten stanowi również o ponad 40 p.p. wyższy odsetek niż latem 2022 roku, kiedy to takich odpowiedzi udzieliło jedynie 6 proc. badanych. Analogicznie grupa wyrażająca pesymizm skurczyła się ponad dwukrotnie – do poziomu 14 proc. Na skłonność inwestorów do podejmowania działań wpływ ma m.in. koszt kapitału. Zdaniem co trzeciego badanego dostępność finansowania powinna w najbliższych latach wzrosnąć. Odsetek ten jest dwa razy większy w porównaniu do poprzedniej edycji ankiety. Prawie połowa badanych nie spodziewa się zmiany obecnych warunków, a co piąty zakłada pogorszenie możliwości uzyskania środków na inwestycje.

Chociaż inflacja pozostaje jednym z największych wyzwań dla współczesnej gospodarki, to z czasem tempo wzrostu cen, a co za tym idzie – wysokość stóp procentowych, powinno spadać. Oczekują tego m.in. prywatni inwestorzy, dla których dostępność kapitału stanowi podstawę działania. W miarę jak banki centralne będą odchodziły od restrykcyjnej polityki monetarnej, oczekiwania uczestników rynku private equity powinny stawać się rzeczywistością, co bez wątpienia przełoży się na wzrost aktywności funduszy w krajach Europy Środkowo-Wschodniej – mówi Michał Tokarski, partner zarządzający działem doradztwa finansowego Deloitte w Polsce, lider zespołu M&A Corporate Finance.

Chociaż inflacja pozostaje jednym z największych wyzwań dla współczesnej gospodarki, to z czasem tempo wzrostu cen, a co za tym idzie – wysokość stóp procentowych, powinno spadać. Oczekują tego m.in. prywatni inwestorzy, dla których dostępność kapitału stanowi podstawę działania. W miarę jak banki centralne będą odchodziły od restrykcyjnej polityki monetarnej, oczekiwania uczestników rynku private equity powinny stawać się rzeczywistością, co bez wątpienia przełoży się na wzrost aktywności funduszy w krajach Europy Środkowo-Wschodniej – mówi Michał Tokarski, partner zarządzający działem doradztwa finansowego Deloitte w Polsce, lider zespołu M&A Corporate Finance.Autorzy raportu podkreślają dalszy wzrost znaczenia czynników ESG dla uczestników środkowoeuropejskiego rynku funduszy private equity, m.in. w obszarze podejmowanych decyzji inwestycyjnych. Ponad 50 proc. przedstawicieli funduszy potwierdziło, że w swoich działaniach zwraca szczególną uwagę na te kwestie. Największy wzrost zaobserwowano wśród podmiotów nieposiadających strategii uwzględniającej ESG, ale planujących zmianę w tym obszarze – z 9 proc. w pierwszej połowie 2023 r. do 23 proc. sześć miesięcy później.Na pytanie dotyczące neutralności klimatycznej większość funduszy odpowiedziała, że znajduje się dopiero na początku drogi do zeroemisyjności. Odsetek podmiotów, które dotychczas wdrożyły zobowiązania i cele dekarbonizacji spadł o 8 p.p. do poziomu 18 proc. Jednocześnie zaobserwowano analogiczny wzrost wśród funduszy będących w trakcie opracowywania własnych celów klimatycznych. Jest to obecnie najbardziej liczna grupa badanych podmiotów, stanowiąca 42 proc wszystkich ankietowanych.

O rosnącym znaczeniu czynników środowiskowych, społecznych oraz związanych z ładem korporacyjnym najlepiej świadczy fakt, że ponad 90 proc. badanych podmiotów bierze je pod uwagę w swoich działaniach lub planuje to zrobić w przyszłości. Jednocześnie ubiegły rok był przełomowy z tego względu, że po raz pierwszy w historii spółka wchodząca w skład lokalnego funduszu private equity uzyskała prestiżowy status B Corporation, stanowiący zobowiązanie do aktywnych działań na rzecz ESG. W najbliższej przyszłości możemy się spodziewać dynamicznego przyrostu takich podmiotów, dla których zaangażowanie w zrównoważony rozwój będzie kluczową kwestią – mówi Irena Pichola, partnerka, liderka Sustainability & Economics Consulting CE, Deloitte.

O rosnącym znaczeniu czynników środowiskowych, społecznych oraz związanych z ładem korporacyjnym najlepiej świadczy fakt, że ponad 90 proc. badanych podmiotów bierze je pod uwagę w swoich działaniach lub planuje to zrobić w przyszłości. Jednocześnie ubiegły rok był przełomowy z tego względu, że po raz pierwszy w historii spółka wchodząca w skład lokalnego funduszu private equity uzyskała prestiżowy status B Corporation, stanowiący zobowiązanie do aktywnych działań na rzecz ESG. W najbliższej przyszłości możemy się spodziewać dynamicznego przyrostu takich podmiotów, dla których zaangażowanie w zrównoważony rozwój będzie kluczową kwestią – mówi Irena Pichola, partnerka, liderka Sustainability & Economics Consulting CE, Deloitte.