W Deloitte stworzyliśmy Strategię Brand Purpose – narzędzie redefiniujące rolę marki i firmy na rynku – integrujące strategię marki, ze strategią ESG oraz strategią biznesową.

Dotychczasowe działania marek, skupione wokół marketingu i ESG nie odpowiadają w pełni na potrzeby klientów. Globalne wyzwania, z którymi zmaga się dzisiaj świat, wywołują do odpowiedzialności nie tylko polityków czy duże organizacje – coraz częściej z krytyką działalności mierzą się obecne na rynku marki. Do presji rynkowej wywieranej przez konkurencję, dochodzą oczekiwania konsumentów w stosunku do wszystkich aspektów działalności organizacji. Konsumenci wymagają od marek zaangażowania w istotne tematy społeczne i środowiskowe oraz większej odpowiedzialności za konsekwencje prowadzenia biznesu.

Wspierając firmy stworzyliśmy narzędzie, które pozwali im dokonać realnej zmiany, wpływając jednocześnie na wyniki biznesowe, budując przewagę konkurencyjną i tworząc długoterminową wartość.

Koncepcja Brand Purpose wynika z rynkowej potrzeby redefiniowania roli marek we współczesnym świecie. W Deloitte wierzymy, że każda marka powinna mieć głębszy cel istnienia. Definiujemy Strategię Celu Marki jako wartość, którą firma swoimi działaniami tworzy w otaczającym ją świecie.

Właściwie zdefiniowany Brand Purpose powinien być prawdziwy, ambitny, inspirujący dla biznesu i ludzi – pracowników i klientów, a przede wszystkim pasować do marki. Dla nas strategia celu marki to nowy model budowania marek zaangażowanych społecznie lub środowiskowo, wyznaczający ambitne horyzonty dla ich biznesowej i społecznej działalności.

Świat zmienia się coraz szybciej wywierając coraz większą presję na działania biznesowe. Katastrofa klimatyczna, zanieczyszczenie środowiska, nierówności społeczne i niepokoje budzą wśród konsumentów coraz więcej niepewności i obaw. Poszukując realnej zmiany i pragnąc mieć większy wpływ na rzeczywistość, konsumenci zmieniają swoje zwyczaje, nawyki zakupowe i coraz częściej kierują się wartościami, które stoją za markami. Nowe zwyczaje zakupowe oznaczają też nowe oczekiwania względem marek, które potrzebują jasno zdefiniowanego Brand Purpose by pozostać konkurencyjne i sprostać rosnącym oczekiwaniom konsumentów.

Coraz więcej konsumentów zaczyna wymagać od marek zaangażowania w kwestie społeczne, odpowiedzialności za wpływ na otoczenie (zarówno naturalne, jak i społeczne) oraz zrównoważonego podejścia. Z kolei nowe marki wchodzące dopiero na rynek coraz częściej wyznaczają sobie ambitny, pozabiznesowy cel jako jeden z głównych motorów prowadzenia działalności.

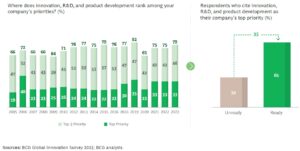

Zdefiniowanie wyższego celu istnienia marki przekłada się nie tylko na budowanie jej wartości, ale również na konkretne zyski dla całej organizacji. Obserwujemy, że marki, które w planowaniu strategicznym oraz codziennych działaniach, kierują się autentyczną wizją i inwestują w działania z zakresu Brand Purpose, rozwijają się szybciej. Generują nowe źródła wzrostu oparte o zrównoważoną ekonomię, zwiększają swoje marże, łatwiej przyciągają i utrzymują pracowników, są sprawniej zarządzane, przyciągają inwestorów i obniżają koszt kapitału.

By Marek Grzybowski

By Marek Grzybowski