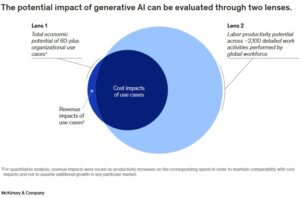

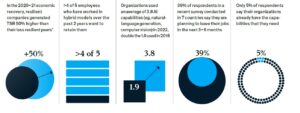

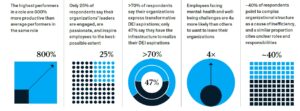

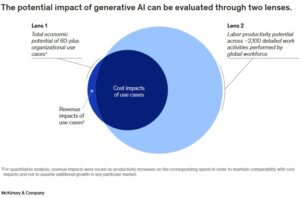

Generative AI is poised to unleash the next wave of productivity. We take a first look at where business value could accrue and the potential impacts on the workforce.

AI has permeated our lives incrementally, through everything from the tech powering our smartphones to autonomous-driving features on cars to the tools retailers use to surprise and delight consumers. As a result, its progress has been almost imperceptible. Clear milestones, such as when AlphaGo, an AI-based program developed by DeepMind, defeated a world champion Go player in 2016, were celebrated but then quickly faded from the public’s consciousness.

Generative AI applications such as ChatGPT, GitHub Copilot, Stable Diffusion, and others have captured the imagination of people around the world in a way AlphaGo did not, thanks to their broad utility—almost anyone can use them to communicate and create—and preternatural ability to have a conversation with a user. The latest generative AI applications can perform a range of routine tasks, such as the reorganization and classification of data. But it is their ability to write text, compose music, and create digital art that has garnered headlines and persuaded consumers and households to experiment on their own. As a result, a broader set of stakeholders are grappling with generative AI’s impact on business and society but without much context to help them make sense of it.

The speed at which generative AI technology is developing isn’t making this task any easier. ChatGPT was released in November 2022. Four months later, OpenAI released a new large language model, or LLM, called GPT-4 with markedly improved capabilities. Similarly, by May 2023, Anthropic’s generative AI, Claude, was able to process 100,000 tokens of text, equal to about 75,000 words in a minute—the length of the average novel—compared with roughly 9,000 tokens when it was introduced in March 2023. And in May 2023, Google announced several new features powered by generative AI, including Search Generative Experience and a new LLM called PaLM 2 that will power its Bard chatbot, among other Google products.

To grasp what lies ahead requires an understanding of the breakthroughs that have enabled the rise of generative AI, which were decades in the making. For the purposes of this report, we define generative AI as applications typically built using foundation models. These models contain expansive artificial neural networks inspired by the billions of neurons connected in the human brain. Foundation models are part of what is called deep learning, a term that alludes to the many deep layers within neural networks. Deep learning has powered many of the recent advances in AI, but the foundation models powering generative AI applications are a step-change evolution within deep learning. Unlike previous deep learning models, they can process extremely large and varied sets of unstructured data and perform more than one task.

More in the McKinsey Report: The economic potential of generative AI

Authors

Michael Chui

Eric Hazan

Roger Roberts

Alex Singla

Kate Smaje

Alex Sukharevsky

Lareina Yee

Rodney Zemmel

Article (PDF) Stats

Article (PDF) Stats Article (PDF) Stats

Article (PDF) Stats Article (PDF) Stats

Article (PDF) Stats Article (PDF) Stats

Article (PDF) Stats Article (PDF) Stats

Article (PDF) Stats Article (PDF)

Article (PDF)