Artificial intelligence will soon change how we conduct our daily lives. Are companies prepared to capture value from the oncoming wave of innovation?

Pity the radiology department at your local hospital. Yes, they have a fine MRI machine and powerful software to generate the images. But that’s where the machines bog down. The radiologist has to find and read the patient’s file, examine the images, and make a determination. What if artificial intelligence (AI) could jump-start that process by enabling real-time and more accurate diagnoses or guidance, beyond what human eyes can see?

Thanks to technological advances over the past few years, manufacturers are close to offering such leading-edge MRI solutions. In fact, they’re exploring new AI applications that span virtually every major industry, from industrials to the public sector. With better algorithms and increased stores of data, the error rate for computer calculations is now often similar to or better than those of human beings for image recognition and several other cognitive functions. Hardware performance has also improved drastically, allowing machines to process this unprecedented amount of data. That has been a major driver of the improvement in the accuracy of AI models.

The evolution of AI

Artificial intelligence (AI) was born in the 1950s, when the English polymath Alan Turing created a test to determine a machine’s ability to mimic human cognitive functions, including perception, reasoning, learning, and problem solving. AI grew with the rise of machine learning (ML)—wherein systems absorb and “learn” from data. They then use this knowledge base to make better predictions and decisions over time. In 2010, the advent of deep neural networks ushered in the deep learning (DL) era.

All ML and DL solutions require two steps: training and inference. Take the software in autonomous cars. To help systems detect obstacles in the road, developers present images to the neural net—for instance, those of dogs or pedestrians—and perform recognition tests. Network parameters are then refined until the neural net displays high accuracy in visual detection. After the network has viewed millions of images and is fully trained, it enables recognition of dogs and pedestrians during the inference phase.

Training now accounts for about 95 percent of AI-related workloads in the public cloud because most AI applications are still relatively immature and require huge amounts of data to refine them. As AI models mature, inference will gain more share in the cloud. In fact, DL inference could account for 30 to 40 percent of public-cloud workloads over the next three to five years, with training dropping to 60 to 70 percent. Inference will also gain share with the rise of edge computing (which takes place within devices), as innovation enables low-power, high-performance inference chips.

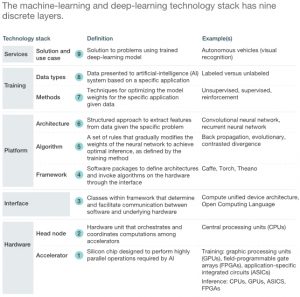

Within AI, deep learning (DL) represents the area of greatest untapped potential. (For more information on AI categories, see sidebar, “The evolution of AI”). This technology relies on complex neural networks that process information using various architectures, comprised of layers and nodes, that approximate the functions of neurons in a brain. Each set of nodes in the network performs a different pattern analysis, allowing DL to deliver far more sophisticated insights than earlier AI tools. With this increased sophistication comes greater needs for leading-edge hardware and software.

Well aware of AI’s massive potential, leading high-tech companies have taken early steps to win in this market. But the industry is still nascent and a clear recipe for success hasn’t emerged. So how can companies capture value and see a return on their huge AI investments?

Our research, as well as interactions with end customers of AI, suggests that six tenets will ring true once the dust settles. First off, value capture will initially be limited in the consumer space, and companies will achieve most value by focusing on enterprise “microverticals”—specific use cases within select industries. Our analysis of the technology stack also suggests that opportunities will vary by layer and that the most successful companies will pursue end-to-end solutions, often through partnerships or acquisitions. For certain hardware players, AI might represent a reversal of fortune, after years of waning interest from investors who gravitated toward software, combined with heavy commoditization that depressed margins. We believe that the advent of AI opens significant opportunities, with solutions in both the cloud and the edge generating strong end-customer demand. But our most important takeaway is that companies need to act quickly. Those that make big bets now and overhaul their traditional strategies will emerge as the winners.

Edge and cloud solutions

Our core beliefs about the future of AI

1. Value capture will initially be limited in the consumer sector

2. Enterprise winners will focus on microverticals in promising industries

3. Companies must have end-to-end solutions to win in AI

4. In the AI technology stack, most value will come from solutions or hardware

5. Specific hardware architectures will be critical differentiators for both cloud and edge computing

6. The market is taking off already—companies need to act now and reevaluate their existing strategies

(…)

Nvidia’s success shows that tech companies won’t win in AI by maintaining the status quo. They need to revise their strategy now and make the big bets needed to develop solid AI offerings. With so much at stake, companies cannot afford to have a nebulous or tentative plan for capturing value. So what are their main considerations as they forge ahead? Our investigation suggests the following emerging ideas on the classic questions of business strategy:

- Where to compete. When deciding where to compete companies have to look at both industries and microverticals. They should select the use cases that suit their capabilities, give them a competitive advantage, and address an industry’s most pressing needs, such as fraud detection for credit-card transactions.

- How to compete. Companies should be searching now for partners or acquisitions to build ecosystems around their products. Hardware providers should go up the stack, while software players should move down to build turnkey solutions. It’s also time to take a new look at monetization models. Customers expect AI providers to assume some of the risk during a purchase, and that could result in some creative pricing options. For instance, a company might charge the usual price for an MRI machine that also has AI capabilities and only require additional payment for any images processed using DL.

- When to compete. High-tech companies are rewarded for sophisticated, leading-edge solutions, but a focus on perfection may be detrimental in AI. Early entrants can improve and rapidly gain scale to become the standard. Companies should focus on strong solutions that allow them to establish a presence now, rather than striving for perfection. With an early success under their belt, they can then expand to more speculative opportunities.

(…)

If companies wait two to three years to establish an AI strategy and place their bets, we believe they are not likely to regain momentum in this rapidly evolving market. Most businesses know the value at stake and are willing to forge ahead, but they lack a strong strategy. The six core beliefs that we’ve outlined here can point them in the right direction and get them off to a solid start. The key question is which players will take this direction before the window of opportunity closes.

About the author(s)

Gaurav Batra is a partner in McKinsey’s Washington, DC, office, Andrea Queirolo is an associate partner in the New York office, and Nick Santhanam is a senior partner in the Silicon Valley office.

More: McKinsey