Many consumer-goods companies have entered the digital and analytics race, but very few are scaling impact. Here’s what leaders are doing right.

Ask any consumer-goods executive if his or her company has invested in digital and analytics, and you’ll almost certainly get an affirmative response. But ask whether those investments have yielded the desired results—and more than half of the time the answer will be no. Our research shows that only 40 percent of consumer-goods companies that have made digital and analytics investments are achieving returns above the cost of capital. The rest are stuck in “pilot purgatory,” eking out small wins but failing to make an enterprise-wide impact. The value at stake isn’t trivial: our analysis suggests that a company’s aptitude at scaling up digital and analytics programs is correlated with its financial performance. In this article, we describe the most common pitfalls that companies encounter in their journey toward digital and analytics scale-up. We also explore an emerging recipe for sustained success.

Measuring digital and analytics maturity—and its value

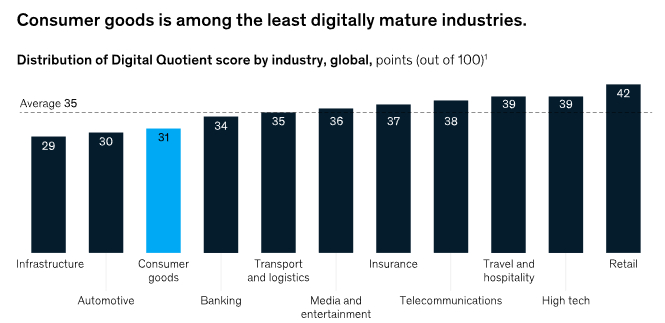

The consumer-goods industry has some catching up to do when it comes to digital maturity. Among 11 industries analyzed in the latest McKinsey Digital Quotient 1 survey, consumer goods ranks third lowest (Exhibit 1). The industry does much better in a comparison of analytics maturity, coming in at fifth place. This isn’t surprising: most consumer-goods companies have focused on established analytical areas (such as pricing) that require relatively little direct consumer data. Sectors with more direct consumer connections, such as retail, have focused more on digital capabilities to enable an omnichannel consumer experience. Within the consumer-goods industry, the companies with the highest levels of digital and analytics maturity are creating significant value. Between 2010 and 2018, the compound annual growth rate (CAGR) for the total shareholder returns (TSR) of the most mature digital and analytics performers—those in the top quintile—was 19.2 percent, approximately 60 percent higher than the 12.3 percent CAGR for bottom-quintile companies. While that analysis doesn’t prove causality, the correlation is compelling. And in light of the growth challenge that the industry is up against, the call to action is loud and clear: either fully tap into the power of digital and analytics, or get left behind.

Drawing on our experience working with consumer-goods players around the world, we have identified the four most common failure modes—the mistakes that hinder organizations from capturing value at scale from digital and analytics:

- Neglecting to connect digital and analytics programs to the enterprise strategy. Laggards tend to treat digital and analytics efforts as side projects rather than important enablers of enterprise-wide priorities. Not surprisingly, these efforts struggle to get the attention and resources they require to succeed.

- Making big investments prematurely. Some companies, enamored of having the latest technology, invest in digital and analytics before they thoroughly understand what the business truly needs and what will deliver significant impact. This failure mode tends to come in two flavors: a company either pursues a costly, all-encompassing “data lake,” without carefully thinking through exactly what that data lake will enable, or invests in a new technology stack in efforts to simplify or harmonize core platforms (such as enterprise-resource-planning systems), only to find that today’s best-in-class tech stack becomes outdated just two years later.

- Holding out for “perfect” hires. Laggards spend as much as six months searching for two or three data scientists or wait until they feel they’ve found the “perfect” hire to lead the team. While it’s not wrong to look for the best data scientists, data engineers, designers, and other skilled people to fill critical roles, there are several ways to accelerate progress while building your technical bench—such as training internal talent, disaggregating roles, or partnering for new capabilities.

- Underinvesting in change management. Executives often tell us that they wish they’d spent as much or more on change management as they did on technology. Without senior business leaders committed to role modeling the changes and a comprehensive plan for encouraging adoption by frontline employees, new techniques won’t stick. As a rule of thumb, digital and analytics leaders should allocate their energy and investment as follows: 25 percent on data, 25 percent on technology, and 50 percent on change management.

MORE: www.mckinsey.com

About the authors: Ford Halbardier is an associate partner in McKinsey’s Dallas office, where Brian Henstorf is a partner; Robert Levin is partner in the Boston office; and Aldo Rosales is an associate partner in the Mexico City office.