As the COVID-19 pandemic erupted, hundreds of thousands of stores across the United States shut their doors, unsure as to when they would reopen. Retail workers have been furloughed or laid off en masse, causing widespread economic pain and deepening the devastation of an unprecedented public-health crisis.

At some point, stores will reopen and people will return to work, as evidenced in countries like China where the pandemic has passed its peak. The timing is uncertain and will differ across US markets, but what’s certain is that stores can’t simply pick up where they left off. COVID-19 has changed consumer behavior, perhaps permanently, and retail stores will need to take these new behaviors into account.

To maximize their potential when they emerge from the crisis, retailers must factor in the realities of the post-coronavirus world. In this article, we share a perspective on the trends that will affect US apparel and specialty retail stores postcrisis and the strategic imperatives that will enable them to thrive in the “next normal.”

How the crisis has changed consumer behavior

Consumers have altered their shopping and buying behavior during the pandemic. For one, loss of income and declining consumer confidence have driven decreases in discretionary spending. In an April 6–12 survey of US consumers, 67 percent of respondents said they expect to spend less on apparel in the near future than they typically do.

A potentially longer-lasting behavioral change is the accelerated adoption of e-commerce. Even before the pandemic, consumers were increasingly browsing and buying online. In the recovery period, retailers could see spikes in online shopping even in categories that in the past were primarily store-based (such as makeup). It’s also possible that e-commerce will attract consumer segments that previously preferred to shop offline, such as baby boomers and Gen Zers. Post-pandemic, apparel executives expect up to a 13 percent increase in online penetration, according to a survey we conducted in early April. Indeed, retailers in Asia—where precrisis online penetration was much higher than in the United States—are expecting a “sticky” increase in online penetration of three to six percentage points as they reopen stores.

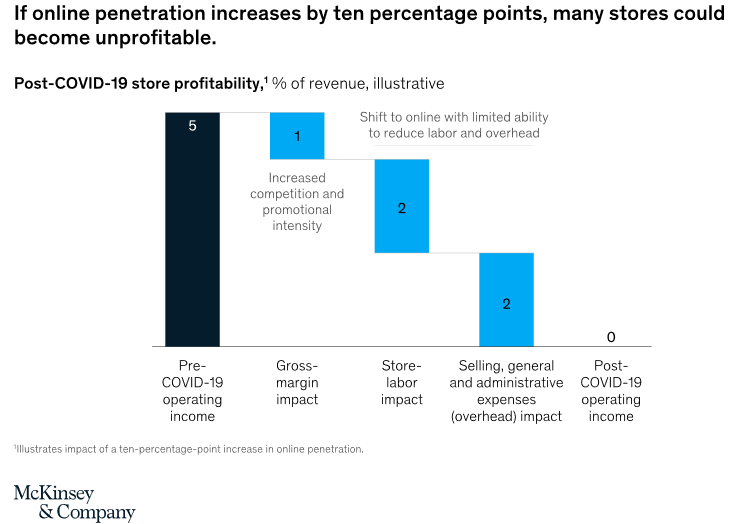

These trends will shape the industry’s next normal and could have profound implications on a retailer’s P&L. Store sales could plummet, fiercer competition and increased operational complexity due to workforce disruptions could contribute to margin compression, and the migration of sales from stores to e-commerce (typically a lower-margin channel for retailers) could further hurt profitability. To illustrate: if online penetration increases by ten percentage points and gross margin falls by one percentage point, driven by increased pricing pressure, retailers could expect store profitability to decline by up to five percentage points (exhibit). A hit to profitability of this magnitude could push a significant number of brick-and-mortar stores into loss-making territory.

About the authors: Praveen Adhi and Andrew Davis are both partners in McKinsey’s Chicago office, where Jai Jayakumar is a consultant; Sarah Touse is an associate partner in the Atlanta office. The authors wish to thank Colleen Baum and Althea Peng for their contributions to this article.

More: https://www.mckinsey.com/industries/retail/