Countries are now able to assess the damage to economic growth wrought in 2020 by the restrictions put in place to control the spread of the COVID-19 virus. All GEI-surveyed economies went into reverse gear in the early months of the year; only China was able to control the virus sufficiently to come out of 2020 with positive economic growth (+2.3% year-over-year). The US economy experienced a GDP contraction of –3.5%; the eurozone as a whole contracted –5.4% (flash estimate), with contractions of –5.0% in Germany, –8.3% in France, –8.8% in Italy, and –11.0% in Spain. The Russian economy, propelled by energy exports, experienced a milder contraction of –3.1%; Brazil’s contraction is expected to be –4.7% and India’s –7.7%.

Economic activity mirrored the fluctuations in pandemic restrictions: many countries loosened restrictions after midyear and experienced strong third-quarter growth. As the number of COVID-19 cases surged again, measures were reimposed, curtailing growth in the last quarter of the year. China was, of course, the exception, as it had controlled the virus early in the second quarter; by the last quarter, the economy was humming at 6.5% y-o-y growth. To a certain extent, China’s success has radiated outward, with demand from China helping to support global manufacturing and trade. This dynamic was underscored in January and February by some deceleration in global indicators in consequence of the new-year holiday in China.

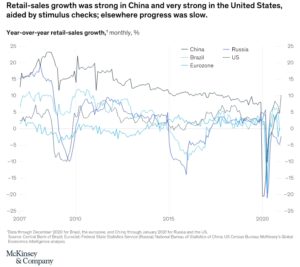

In the most recent available data, consumer-sentiment indicators were subdued or pessimistic in most surveyed economies; in China, however, consumer confidence strengthened. Retail-sales growth was very strong in the United States (+5.3% month-over-month), aided by individual stimulus payments; in China, retail sales expanded 4.6%; elsewhere, consumer spending retreated or is making slower progress (Exhibit 1).

As measured by global purchasing managers indexes (PMIs), growth in both manufacturing and services eased in January. Among surveyed economies, manufacturing PMIs remain strong. Services PMIs in the United States and Russia experienced strong growth; in China, the indicator slowed in advance of the new-year holiday; for the eurozone and Brazil, contraction is indicated.

World trade volumes now exceed prepandemic levels: as measured by the CPB World Trade Monitor, global volumes increased 0.6% in December 2020 and 1.6% in November; the indicator showed a trade expansion of 11.5% in the third quarter of 2020 and 4.0% in the fourth quarter (after contractions of –2.6% and –11.7% in the first and second quarters, respectively, figures revised). The Container Throughput Index declined slightly to 119 in December (121.1 in November); a seasonal retreat was measured in Chinese ports.

More: https://www.mckinsey.com/

About the authors:The data and analysis in McKinsey’s Global Economics Intelligence are developed by Alan FitzGerald, a director of client capabilities in McKinsey’s New York office; Krzysztof Kwiatkowski, a capabilities and insights specialist, and Vivien Singer, a capabilities and insights expert, both at the Waltham Client Capability Hub; and Sven Smit, a senior partner in the Amsterdam office.