By Marek Grzybowski

With Russia’s invasion of Ukraine, new players appeared on the maritime transport market. The demand for used tankers has increased, which has driven freight rates up after a long period of stagnation, and this has encouraged new players to enter the market dynamically.

Trading in old tankers has become an opportunity to do business and support crude oil trading on new routes. As always, war drives business to those who take advantage of the opportunity. The turmoil in the oil transportation market has meant that sellers and buyers, tanker operators and oil suppliers profit from the war.

The sanctions imposed on trade in Russian oil and petroleum products, which entered into force in December 2022 and February 2023, increased the activity of tanker operators and allowed new players to enter the market. Some of them are pointed out by Rebecca Galanopoulos Jones, who runs the VV blog.

As a result, with the continued demand for oil and the slowdown in supply via pipelines to recipients in Europe, oil streams began to flow through the sea instead of via pipelines. Oil exports from the Arabian Gulf increased by 12.8% y/y to 880.1 million in 2022 and accounted for 42.9% of global oil trade by sea.

Exports from Russia also increased by 10.4% year on year to 218.7 million tonnes and accounted for 10.7% of the global supply of this raw material. The US increased supply and exports increased by 22.9% year-on-year to 165.1 million tonnes, according to Bancosta in its latest report.

“We are looking at new and opportunistic players that have entered the tanker market. We analyze what they bought and what impact this had on the respective market values, especially as the demand for older ships continues to grow,” emphasizes Rebecca Galanopoulos Jones, VV blogger.

“Gatik Ship Management, based in India, is one of the most interesting companies to emerge in the last 18 months,” remarks Rebecca Galanopoulos Jones.

Previously unknown on the maritime transport market, the entity has recently acquired a significant number of ships and as of December 2021 has been operating 53 tankers with a tonnage of over 37,000. up to 318 thousand two tues It has an average age of 17 and a total market value of $1.5 billion.

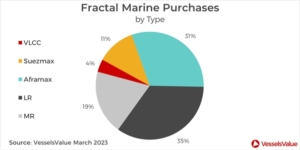

Fractal Marine Shipping is another new player in the market that has been noticed by Rebecca Galanopoulos Jones of VesselsValue. The shipowner has grown rapidly over the past year. Fractal is based in Geneva and registered in the United Arab Emirates. The operator manages a fleet of tankers. As of March 2020, the company has built a fleet of 27 ships, of which 26 have been purchased since May 2022. Recently purchased ships are between 9 and 14 years old.

Radiating World Shipping Services, headquartered in the United Arab Emirates, purchased its first vessel in December 2022 and has since acquired a total of 12 tankers, including 6 Aframaxes and 6 MRs, with an average age of 17 years.

More: VesselsValue Blog, Winword, Revinitiv, Bancosta Research; War on land, business at sea GospodarkaMorska.p