Many of today’s business leaders came of age studying and experiencing a classical model of competition. Most large companies participated in well-defined industries selling similar sets of products; they gained advantage by pursuing economies of scale and capabilities such as efficiency and quality; and they followed a process of deliberate analysis, planning, and focused execution. The traditional playbook for strategy is no longer sufficient. In all businesses, competition is becoming more complex and dynamic. Industry boundaries are blurring. Product and company lifespans are shrinking. Technological progress and disruption are rapidly transforming business. High economic, political, and competitive uncertainty is conspicuous and likely to persist for the foreseeable future.

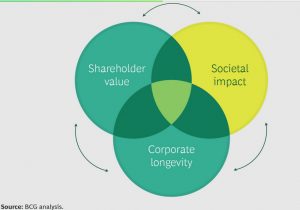

Accordingly, in addition to the classical advantages of scale, companies are now contending with new dimensions of competition—shaping malleable situations, adapting to uncertain ones, and surviving harsh ones—which in turn require new approaches. And the stakes are higher than ever: the gap in performance between the top- and bottom-quartile companies has increased in each of the past six decades.1

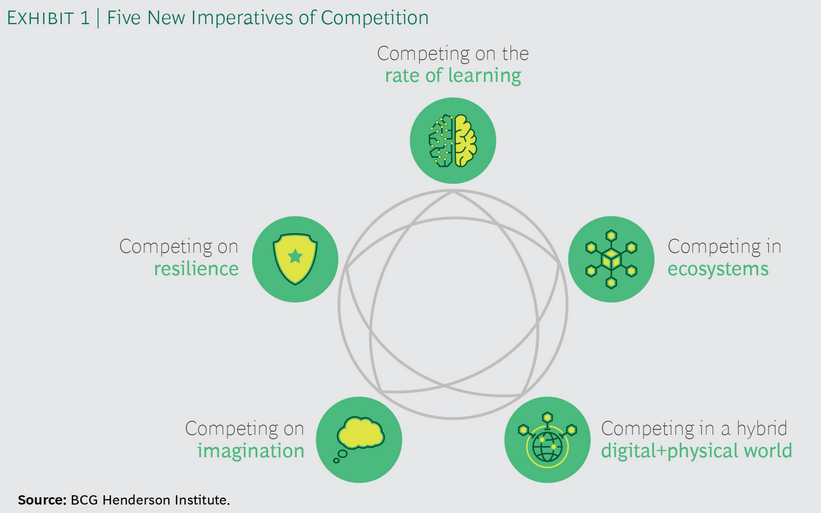

Today’s business leaders are dealing with complex competitive concerns in the short run. But as the 2020s approach, they must also look beyond today’s situation and understand at a more fundamental level what will separate the winners from the losers in the next decade. We see five new imperatives of competition that will come to the forefront for many businesses (See Exhibit 1):

- Increasing the rate of organizational learning

- Leveraging multicompany ecosystems

- Spanning both the physical and the digital world

- Imagining and harnessing new ideas

- Achieving resilience in the face of uncertainty

In short, the logic of competition has changed—from a predictable game with stable offerings and competitors to a complex, dynamic game that is played across many dimensions. Leaders who understand this, and re-equip their organizations accordingly, will be best positioned to win in the next decade.

Competing on Resilience

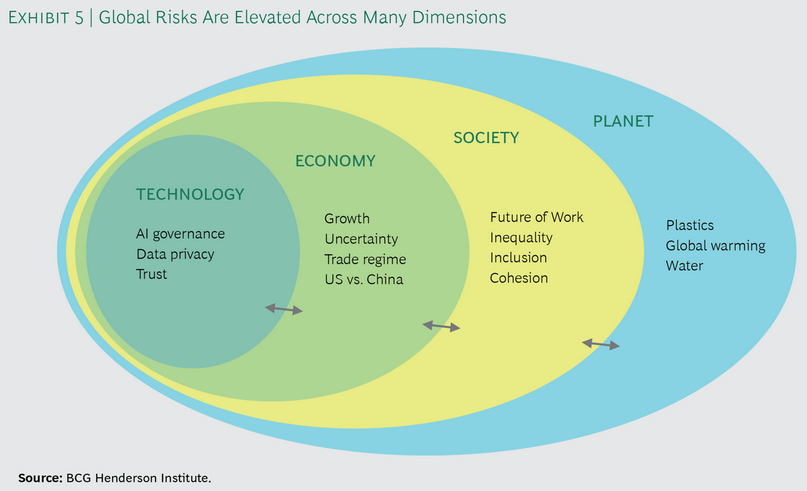

Looking ahead to the 2020s, uncertainty is high on many fronts. Technological change is disrupting businesses and bringing new social, political, and ecological questions to the forefront. Economic institutions are under threat from social divisions and political gridlock. Society is increasingly questioning the inclusivity of growth and the future of work. And planetary risks, such as climate change, are more salient than ever.

Furthermore, deep-seated structural forces indicate this period of elevated uncertainty is likely to persist: technological progress will not abate; the rise of China as an economic power will continue to challenge international institutions; demographic trends point toward an era of lower global growth, which will further strain societies; and social polarization will continue to challenge governments’ ability to effectively respond to national or global risks. (See Exhibit 5.)

Under such conditions, it will become more difficult to rely on forecasts and plans. Business leaders will need to consider the larger picture, including economic, social, political, and ecological dimensions, making sure their companies can endure in the face of unanticipated shocks. In other words, businesses will effectively need to compete on resilience.

Survival is already challenging for many businesses today. Building resilience is often at odds with traditional management goals like efficiency and short-run financial maximization. But to thrive sustainably in uncertain environments, companies must make resilience an explicit priority:

- Prepare for a range of scenarios to ensure that strategy is robust and risks are survivable.

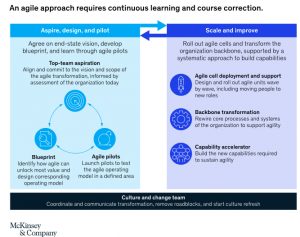

- Build an adaptive organization that can rapidly adjust to new circumstances—for example, by constantly experimenting to identify new options.

- Proactively contribute to collective action on the biggest issues facing global economies and societies, in order to maintain a social license to operate.

By Ryoji Kimura, Martin Reeves, and Kevin Whitaker

More: The BCG Henderson Institute is Boston Consulting Group’s strategy think tank, dedicated to exploring and developing valuable new insights from business, technology, and science by embracing the powerful technology of ideas. The Institute engages leaders in provocative discussion and experimentation to expand the boundaries of business theory and practice and to translate innovative ideas from within and beyond business. For more ideas and inspiration from the Institute, please visit Featured Insights.