|

|

|

|

|

|

By Marek Grzybowski

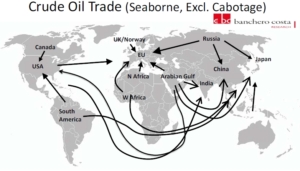

About 2.16 billion tonnes of crude oil were pumped through marine fuel terminals, of which the European Union’s marine terminals reloaded over 470 million tonnes in 2023. This result was surpassed by the economy of the People’s Republic of China, which imported 512 million tons by sea in the period January-December 2023, says Banchero Costa in the latest report. The Port of Gdansk is among the leading EU ports transshipping crude oil.

The war in Ukraine and disruption in supply chains made it another good year for oil trading companies. Demand for this energy raw material has increased despite high oil prices and the economic recession in many markets.

Despite the slowdown in many industrial and consumer markets, in the period January-December 2023, global transport of crude oil by sea increased by 5.3% y/y and reached 2,160.6 million tonnes, according to information based on data from observations of tanker traffic conducted by Refinitiv Maritime, excluding all cabotage trade.

In earlier years, global seaborne crude oil shipments were lower. In the period January-December 2022, they exceeded 2,050.9 million tons, and in 2021, 1,886.3 million tons were loaded onto tankers, while in 2019, 2,110.5 million tons were transported by sea between fuel terminals.

Persian Gulf – over 40% of global supplies

The dominant region and source of supplies is the Persian Gulf region. In the period January-December 2023, supplies from oil fields located in this region decreased by 1.4%. y/y to 869.1 million tons. Arab oil is still the dominant source of supply for many recipients, and recently also for Poland. Supplies from the Persian Gulf accounted for 40.2% of global maritime oil trade in 2023.

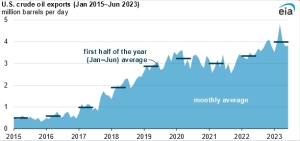

Exports from Russian ports increased in 2023 by 5% y/y to 229.5 million tons. This is 10.6% of the supply in global crude oil trade. From the USA, exports of this raw material increased by 19.5% y/y to 197.2 million tons. From West Africa, oil exports last year increased by 2.5% y/y and reached 174.8 million tons. Exports from South America increased by 20.8% y/y. and 157.6 million tons were loaded onto tankers. Exports from the oil fields of Northwest Europe increased by 3.4% y/y to 111 million tons.

China’s economy generated demand for 23.7% of global supplies

The largest maritime importer of crude oil in 2023 was the PRC. China’s economy generated demand for 23.7% of global supplies. Oil supplies to China increased in the period January-December 2023 by 16.6% y/y to 512 million tons, while a year earlier it was over 70 million tons less (439.9 million tons in 2022).

India’s imports increased by 1.9% y/y to 228.2 million tonnes. This means that India generates 10.6% of global demand. The South Korean economy imported +2.7% more in 2023 than the previous year. Fuel terminals pumped 140.4 million tons of crude oil from tankers. Japan reduced imports by 8.1% y/y. 121.6 million tons of crude oil were unloaded at the fuel terminals of Japanese ports.

The European Union is the second global importer

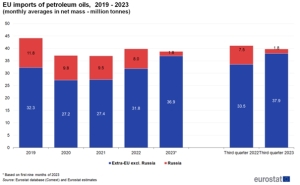

The European Union is the world’s second largest importer of crude oil by sea. In 2022, it overtook China. However, in the period January-December 2023, imports by sea to the European Union (27) increased at a rate four times lower than imports from China. It was only 4.7% y/y. As a result, tankers delivered 472.4 million tonnes to fuel ports in the EU. In 2023, the EU accounted for 21.9% of global crude oil trade.

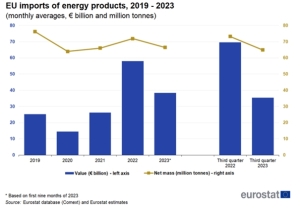

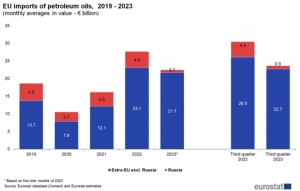

EUROSTAT points out that “the observed significant fluctuations in EU oil imports [Ministry of Economy] are a consequence of high price volatility. The share of crude oil [in value terms – Ministry of Economy] in total EU imports increased from 9.1% in 2021 to 11% in 2022 and decreased slightly to 10.6% in the first three quarters of 2023.

EU countries, including Poland, increased their imports of crude oil. In 2022, the economies of EU countries imported 388.8 million tons, a year earlier it was over 402.5 million tons, while in 2019 the EU needed 446 million tons of oil imported through fuel terminals.

Increased spending on oil imports

These volumes also translated into an increase in spending on crude oil imports. The average monthly import from Russia decreased in 2021-2022, but due to rising prices, the value of imports from Russia also increased (EUR 0.6 billion). Imports from other non-EU partners increased, which meant that EUR 10.9 billion more had to be paid for supplies, according to EUROSTAT. – In the first three quarters of 2023, the trend was reversed, and the total average values decreased by 19% compared to 2022 (from EUR 27.6 billion in 2022 to EUR 22.4 billion in Q1-Q3 2023 y.) – says EUROSTAT.

About 14% of the crude oil delivered to the EU by tankers in 2023 was transported on VLCCs, about 43% arrived on Suezmax tankers and about 42% was offloaded from Aframax ships, reports Banchero Costa Research.

Rotterdam was the port with the largest volume of received oil delivered to the EU. In 2023, 101 million tons of crude oil reached the refineries located in its zone by sea. In second place was the Northern Port in Gdańsk, whose terminals pumped 37.6 million tons (in 2022 – 25.5 million tons).

– Naftoport has become an oil hub for the region. It is through the Gdańsk fuel terminal that the refining needs of both Poland and our closest neighbors are secured. Naftoport last year reloaded a total of 36.6 million tons of crude oil and fuels. Part of this cargo is supplies to German refineries. After cutting off supplies via the “Przyjaźń” oil pipeline from Russia, Poland became the most important gateway for them, informed the Port of Gdansk Authority.

In third place is the seaport of Trieste, to which tankers delivered 36 million tons. Next are the fuel terminals in Fos (22.0 million tons), Le Havre (19.3 million tons), and Wilhelmshaven (17.9 million tons). The following ports handled less than 15 million tons in 2023: Cartagena (14.3 million tons), Sarroch (12.2 million tons), Augusta (11.4 million tons), Algeciras (10.2 million tons), Tarragona (9, 8 million tons), Lysekil (9.5 million tons).

Turbulences in crude oil logistics

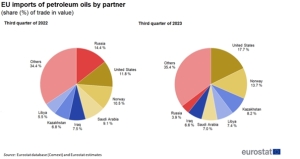

European Union countries have been hit hard by the turmoil in crude oil logistics. Ship deliveries had to replace pipeline transport. It was necessary to change the countries and ports from which oil was imported in 2023. Not everything went as expected and holes appeared in the sanctions through which oil from Russia leaked.

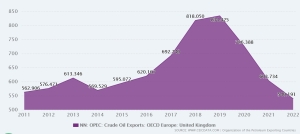

However, changes in logistics chains have changed transshipment in many countries and ports, both on the export and import side. In the period January-December 2023, supply from Russian ports (including Kazakh oil) decreased by 40.4% y/y compared to 2022 and 47.9% compared to 2021 compared to 2021. In 2023 58.6 million tons were exported through Russian terminals, while in the previous year it was 98.4 million tons, and in 2021 112.5 million tons.

Ukrainian drone attack on the ports of St. Petersburg and Ust Luga caused the Governor of the Leningrad Oblast, Aleksandr Drozdenko, to announce an alarm for ports in January and introduce the highest level of threat to critical infrastructure facilities. The alarm was announced in all areas of the oblast. In particular, it applies to terminals with installations located in the ports of Vyborg, Vysotsk and Primorsk.

Currently, Novorossiysk is the largest port exporting crude oil to the EU. In 2023, it amounted to 47.4 million tons. Russian ports have dropped in the ranking of oil suppliers to the EU over the last 2 years. However, they are the fourth supplier of crude oil to the EU transported by sea.

USA, Norway and Great Britain in the oil gap after sanctions

This is only 12.4% of the volume in the period January-December 2023. British and Norwegian oil from the North Sea accounted for last year. 18.6% of deliveries to the EU. Production companies from North Africa provide 17.3% of supplies, and 15.4% of the oil imported by EU countries arrives from the USA via tankers.

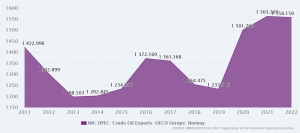

As a result of the sanctions imposed on Russian oil, supplies to the EU from the North Sea (Norway and Great Britain) increased by 14% year on year. In the period January-December 2023, 87.8 million tonnes arrived by tankers from British and Norwegian offshore drilling to EU ports.

Imports from North Africa (including Sidi Kerir) increased by 17.3% y/y to 81.7 million tonnes in January-December 2023. Imports from the US increased by 41.5% y/y, reaching a new record all-time amounting to 72.8 million tons.

Supplies from West Africa to Europe increased by 8.2% y/y to 54.4 million tonnes in 2023. Direct supplies from the Persian Gulf also increased sharply. In 2023, the supply dynamics reached 32.2% y/y to 45.3 million tons. The volume of deliveries from Turkey (Ceyhan) decreased by 32.7% y/y to 23 million tons from 34.2 million tons in January-December 2022.

The sanctions imposed on Russia have resulted in a significant decrease in direct imports of Russian oil to the European Union. Now the country’s oil comes indirectly through operators and traders using “gray” or “black” fleets.

Transfer ports are also cleverly used, where oil from ships carrying Russian oil is transferred to ships operating on official registers. STS operations – pumping oil in bays or in port roadsteads – are also common.

Russian oil also reaches EU ports in the form of products produced in refineries of third countries that have not imposed sanctions. And so, thanks to leaking sanctions, oil from Russia reaches European Union ports.

As generative AI (GenAI) and other disruptive technologies rapidly transform the business landscape, companies are recognizing the strategic imperative of workforce reskilling. Indeed, according to a 2023 BCG survey, 75% plan to make significant investments in talent retention and development. Yet historically, even significant investments in upskilling programs often yielded disappointing results. One key reason is that companies haven’t found a reliable way to measure their programs’ impact, despite many attempts to create such mechanisms over the past 50 years.

Through our work with clients, we have developed a three-step approach to help companies better measure “return on learning investment” for some dimensions of organizational upskilling programs. ROLI enables companies to: 1) identify upfront the business outcomes or impact they are looking to achieve; 2) define the metrics they will use to hold the program accountable to that impact and measure progress; and 3) determine whether that impact has been achieved.

With these ROLI principles in mind, companies can design upskilling programs with demonstrable impact on revenues, costs, customer satisfaction, and innovation speed, ultimately improving margins and delivering on other business objectives.

It’s not hard to see why companies traditionally have had limited success measuring the impact of their upskilling programs. First, the measurement mechanism itself is very difficult. It’s one thing to track the time an employee spends in an upskilling program. But tracking them through their workflow to determine how they’ve applied their new skill sets is another thing altogether.

Even if it were possible to determine that a person’s performance had improved since the upskilling program, it’s not easy to distinguish correlation from causation. Since controlled studies aren’t realistic, it’s hard to know whether an upskilling program was responsible for the change or if other factors, such as motivation, manager input, or market dynamics played a role.

Another issue is that the impact of any single upskilling program isn’t typically immediately apparent. That’s because the upskilling cycle takes time—both acquiring the skills and then putting them to work in a way that has a business impact. And because leaders have different motivations for investing in upskilling, there isn’t a universally recognized measure of success or even an approach for tracking impact. Some leaders look for productivity improvements, others look for better retention, and still others look to boost their brand.

Despite these challenges, organizations that make a clear connection between the skills being learned and specific KPIs can measure the impact of upskilling programs on their own employees; the maturity of the ecosystem (how fast the organization can upskill and adapt compared with its competitors); and business performance.

While all three are undeniably important, the business impact is paramount, given the substantial investment needed to build scaling capabilities. For example, an upskilling program to facilitate a digital transformation in a global company can require an investment of millions of dollars. Only programs that will arguably unlock meaningful value for employees and the enterprise will get the green light.

More: BCG

By Marek Grzybowski

By Marek Grzybowski

CruiseBritain members ended 2023 with success and high revenues for ports and cities. The Port of Dover was named ‘Best UK Departure Port’ and the Port of Belfast ended the year with the ‘Best UK & Ireland Port of Call’ title. Over 460 cruise ship calls and 2.6 million passengers visiting Southampton contributed over £1 billion to the local and regional economy.

In Southampton, there are over 15,000 people in the maritime tourism sector. jobs offered by local entrepreneurs, both those operating in ports and serving tourists in the city and Hampshire.

Stephen Manion, executive director of Go! Southampton, said: Cruise passengers are an extremely important part of the Southampton and Hampshire tourism economy – quotes the director of CruiseBritain.

Maritime tourists visit Hampshire for its charming scenery. It is a land located in the south of England, situated on the English Channel and the Solent Strait. According to the local tourism organization, they spend more than average.

Go! Southampton

“We look forward to working with the Port of Southampton to increase not only visitor numbers, but also their ability to access the city and all its attractions,” says Stephen Manion.

The operator of the Port of Southampton is Associated British Ports (ABP). Southampton Airport is 5 miles from the port. It is one of the leading cruise ports in Europe. It is distinguished by five cruise terminals. The new Cruise Terminal (Berth 102) was built as a joint venture between MSC Cruises and Norwegian Cruise Line Holdings. The terminal also serves luxury cruise lines Regent Seven Seas Cruises and Oceania Cruises.

The Port of Southampton is home to the UK’s first high-capacity land-based power plant used to power ships. It allows cruise ships to provide electricity from the quayside. This allows combustion engines to be turned off in the port. This, in turn, enables the port to achieve zero emissions, which is one aspect of ABP’s commitment to sustainable development.

Another activity of ABP is encouraging passengers to use public transport. – We are working with the City Council and port partners to ensure that air quality levels continue to be below nationally set thresholds, and thanks to port air quality monitors we can accurately measure this – emphasizes ABP.

Alastair Welch, ABP regional director for Southampton, said: “We are proud of the role we play in supporting the local, regional and national economy. While this is a record year for cruises, we continue to invest in this and other port-related sectors to ensure the long-term success of our port city.

Dover – the White Cliffs region

Commenting on Dover’s win in the ‘Best UK Departure Port’ category, Cruise Critic UK & AU said: ‘as well as its stunning location and welcoming White Cliffs, Dover serves an increasing number of cruise lines, including Seabourn, Fred. Olsen, Hurtigruten, Costa and Carnival Pride. We also positively assess investments in infrastructure and sustainable development, including the construction of a completely new marina and cooperation with local and international partners in order to create a port that is more friendly, sustainable and equipped with modern technologies,” reported “Cruise Critic UK & AU”.

Doug Bannister, Chief Executive Officer of the Port of Dover, said upon receiving the award: “This is the perfect end to a great year for Dover Cruise and a testament to the world-class customer service provided by our team. Leading cruise lines have chosen the iconic backdrop of the White Cliffs and Dover Castle for launch visits and special celebrations throughout the year, states Bannister. – My thanks go to our team for providing hundreds of thousands of cruise guests with lifelong memories in 2023, and to our cruise lines for choosing Dover as their number one destination in the UK. See you in 2024! – said Doug Bannister, quoted by CruiseBritain.

“It has been a phenomenal year for the cruise industry,” said Adam Coulter, editor-in-chief of Cruise Critic UK & AU. He noted that not only had record sales been achieved, but also that “travellers come to the seaside for a high-quality holiday. And for travelers based in the UK, the introduction of new ships has helped to further drive interest in cruises.”

Belfast – “Best UK & Ireland Port of Call”

The Port of Belfast has been named ‘Best UK & Ireland Port of Call’ in the 15th edition of the Cruise Critic UK Editors’ Picks Awards.

The Port of Belfast Authority earned this award by serving 159 calls from 32 cruise operators in 2023, an 8% increase on the record set in 2019.

Cruise Critic, a subsidiary of TripAdvisor, is the world’s leading cruise review site and online cruise community. Each year it announces the winners of the Editors’ Picks Awards, selected by an international panel of cruise experts.

After receiving the Cruise Critic award, Michael Robinson, director of Belfast Harbour, said: “This award recognizes the fantastic work that everyone in the cruise industry has done to create a product that will ensure the satisfaction of visitors to Northern Ireland.

Robinson highlighted that there has been significant investment in cruise ship facilities in Belfast.

– We receive positive opinions from passengers, crew and cruise line management, both about the high level of services provided and the quality of the tourist offer – noted Robinson. – As part of Cruise Belfast, our partnership with Visit Belfast, a lot of work has been done to promote the region and attract visitors here. Working with tour operators, the hospitality sector and industry organizations, we have helped create an attractive offer that gives cruise lines the confidence to return to the region and increase the number of connections they make each year, emphasized Robinson.

Gerry Lennon, chief executive of Visit Belfast, said: “Belfast is a fascinating, unique destination, rich in history, culture, heritage and attractions, boasting great hospitality, a rich shopping offer and a wealth of world-class attractions. I am delighted that its success has been officially recognized this year by Cruise Critic as the best port of call in the UK and British Isles.

In 2024, from Dover to Norway, Iceland, Portugal and the Azores

British ports predict that 2024 will be even better than 2023. 90 ships will visit Portsmouth this year, which will make 2024 a record year in terms of cruise ship moorings. This is the result of ten new calls. About 155,000 people will arrive on ships. passengers. Many of them will start their journey in the new terminal.

In 2024, Dover residents will witness six inaugural calls. There will even be days with three ships mooring at the passenger terminal at the same time – emphasizes the Port of Dover management. There is also a new marina on the newly developed Dover waterfront. The Marina Curve and Clocktower Square recreational areas adjacent to the terminal are now open for use.

– There is no doubt that 2024 will be an unforgettable year for us. We look forward to the return of all our cruise services and look forward to welcoming those operators who are visiting us for the first time,” said Peter Wright, Cruise Director at the Port of Dover.

The increased activity of cruise owners is evidenced by Clare Ward’s statement. Director of Products and Customer Service at Fred. Olsen Cruise Lines, said: “We are delighted to be back in Dover again with five new cruises launching this summer to attractive ports including Norway, Iceland, Portugal and the Azores.

20 tour operators have contracted entries. From Dover, there are cruises to Norwegian fjords, Baltic Sea ports, and ports of the British Isles. It is also the home port for the world’s leading cruise lines.

It should be added that you can travel from Dover to London by high-speed rail. After an hour, passengers get off at Victoria station, in the center of the British capital, a dozen or so minutes’ walk to Buckingham Palace.

Photos: Cruise port authorities: Dover, Southampton, Belfast

Inflacja, spowolnienie gospodarcze, rozwój e-commerce i nowych technologii jako pola rywalizacji o serca i kieszenie konsumentów – to wyzwania dla firm zajmujących się handlem detalicznym. Dodatkowo na te obszary nakładają się zmieniające się preferencje konsumentów, a konieczność dostosowania do nich strategii operacyjnych staje się nie lada wyzwaniem.

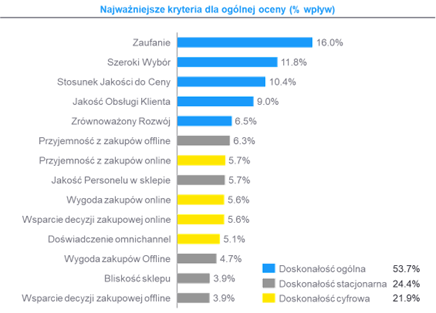

Jak wynika z polskiej edycji badania EY dotyczącego handlu detalicznego – Retail Performance Ranking 2023 – cena jest wciąż ważna dla kupujących, ale nie pozostaje jedynym kryterium wyboru. Wyżej od niej zostały ocenione takie czynniki, jak zaufanie oraz szeroki wybór.

– Współczesny konsument przejawia zaufanie do marki sklepu i ceni szeroką ofertę produktową, wybierając detalistów z długą historią na rynku. W ten trend od wielu lat wpisują się w Polsce także sklepy w formacie dyskontu, które nie tylko przyciągają klientów ofertą najniższej ceny, ale kuszą także bogatym asortymentem na półce – mówi Arkadiusz Gęsicki, Partner EY-Parthenon w Polsce i krajach bałtyckich z zespołu Strategia i Transakcje w EY Polska.

W odniesieniu do dostawców zakupów i żywności stosunek jakości do ceny był drugim najważniejszym kryterium wyboru. W ich przypadku głównym parametrem była cena dostawy, a propozycja wartości wyglądała podobnie u wszystkich. Inną grupą, w której wpływ kryterium cenowego okazał się drugim najważniejszym, są sklepy z ogólnym asortymentem. Na tym rynku niespożywcze dyskonty uczyniły cenę swoim głównym wyróżnikiem.

Co ciekawe, jedynym segmentem, w którym jakość obsługi klienta miała większy wpływ na ogólną ocenę niż cena oferowanych produktów, były internetowe platformy handlowe. Może to wynikać z faktu, że dają one możliwość szybkiego porównania ofert, więc ważniejszym aspektem staje się wygoda obsługi i ogólnie rozumiana jakość doświadczenia zakupowego.

Badanie EY pokazało, że doskonałość w kryteriach cyfrowych mniej wpływa na ogólną ocenę sprzedawców niż doskonałość w kryteriach ogólnych, takich jak zaufanie, szeroki wybór lub zrównoważony rozwój.

Widać również, że spośród 51 przebadanych sprzedawców detalicznych posiadających placówki fizyczne (z wyłączeniem internetowych platform handlowych oraz dostawców zakupów i żywności), tylko czterech odnotowało wyższą pozycję za doskonałość cyfrową niż sklepy stacjonarne, w tym dwóch z segmentu sprzedawców elektroniki i AGD, który z założenia jest bardziej cyfrowy i tym samym otwarty na kanał online.

We wszystkich siedmiu segmentach wielokanałowych konsumenci przyznawali, że częściej sprawdzają ofertę online (w zależności od segmentu – od 31 do 79%), za to rzadziej kupują w tym kanale (od 12 do 74%). Tylko w przypadku elektroniki i AGD, książek oraz artykułów dziecięcych większość respondentów deklarowała częstsze zakupy online niż offline.

– Doskonałość cyfrowa, czyli np. przyjemność i wygoda zakupów online, we wszystkich segmentach pozostaje mniej ważna od doskonałości ogólnej, np. szerokiego wyboru czy jakości obsługi. Nadal więcej konsumentów przegląda oferty online, niż w ten sposób kupuje – podsumowuje Grzegorz Przytuła, Partner EY-Parthenon, ekspert ds. sektora handlu i produktów konsumenckich.

Działania sprzedawców w obszarze zrównoważonego rozwoju znalazły się na 5. miejscu wśród najważniejszych kryteriów wskazywanych przez konsumentów. Polska jest więc trzecim rynkiem (spośród siedmiu objętych badaniem), na którym zrównoważony rozwój znalazł się w pierwszej piątce kluczowych wymiarów – tuż po USA i Hiszpanii. Znaczenie tej kategorii, przynajmniej na poziomie deklaracji, jest w wyborach konsumenckich coraz większe.

Zrównoważony rozwój jest także brany pod uwagę, jeśli chodzi o miejsce dokonywania przyszłych zakupów przez polskich konsumentów. Teraz najważniejsze jest dla nich zaufanie, ale w prognozach wskazują, że fotel lidera zajmie zrównoważony rozwój. Klienci chcą korzystać ze sklepów, które są bardziej zrównoważone, co dla 75% respondentów oznacza nowoczesność oraz innowacyjność.

Jednocześnie, jak pokazało badanie EY Future Consumer Index, ceny ekologicznych produktów są postrzegane jako wysokie. W pierwszej połowie 2023 r. sądziło tak 84% ankietowanych. Ich zdaniem wygórowane ceny zmniejszą wielkość sprzedaży i wpłyną na niższe perspektywy wzrostu rynku produktów ekologicznych.

– Detaliści muszą dostosować się do zmieniających się preferencji konsumentów, dla których zaufanie, szeroki wybór, jakość obsługi klienta i zrównoważony rozwój są kluczowymi wartościami. Cena nie jest już jedynym decydującym czynnikiem w dążeniu do długotrwałego sukcesu biznesowego. Zrównoważony rozwój nabiera znaczenia, ale wyższe ceny ekologicznych produktów są dla konsumentów barierą, zwłaszcza w czasach kryzysu – zauważa Grzegorz Przytuła.

Retail Performance Ranking to cykliczne, międzynarodowe badanie wykonywane na zlecenie EY-Parthenon oceniające detalistów według ich doskonałości stacjonarnej, cyfrowej i ogólnej. Zostało przeprowadzone w 7 krajach, obejmując ponad 900 sprzedawców detalicznych z 10 segmentów biznesowych oraz ponad 45 tys. respondentów. W badaniu przeprowadzonym w 2023 r. po raz pierwszy wzięli udział respondenci z Polski: 2800 ankietowanych oceniło 65 różnych sprzedawców detalicznych.

Celem działalności EY jest budowanie lepiej funkcjonującego świata – poprzez wspieranie klientów, pracowników i społeczeństwa w tworzeniu trwałych wartości – oraz budowanie zaufania na rynkach kapitałowych.

Wspomagane przez dane i technologię, zróżnicowane zespoły EY działające w ponad 150 krajach, zapewniają zaufanie dzięki usługom audytorskim oraz wspierają klientów w rozwoju, transformacji biznesowej i działalności operacyjnej.

Zespoły audytorskie, consultingowe, prawne, strategiczne, podatkowe i transakcyjne zadają nieoczywiste pytania, by móc znaleźć nowe odpowiedzi na złożone wyzwania, przed którymi stoi dziś świat.

EY w Polsce to ponad 5000 specjalistów pracujących w 8 miastach: w Warszawie, Gdańsku, Katowicach, Krakowie, Łodzi, Poznaniu, Wrocławiu i Rzeszowie oraz w Centrum Usług Wspólnych EY.

Działając na polskim rynku co roku EY doradza tysiącom firm, zarówno małym i średnim przedsiębiorstwom, jak i największym firmom. Tworzy unikatowe analizy, dzieli się wiedzą, integruje środowisko przedsiębiorców oraz angażuje się społecznie. Działająca od ponad 20 lat Fundacja EY wspiera rozwój i edukację dzieci oraz młodzieży z rodzin zastępczych, zwiększając ich szanse na dobrą przyszłość, a także pomaga opiekunom zastępczym w ich codziennej pracy. Każdego roku Fundacja EY realizuje około 20 projektów pomocowych, wspierając w ten sposób ponad 1300 rodzin zastępczych.

EY Polska od 2003 roku prowadzi polską edycję międzynarodowego konkursu EY Przedsiębiorca Roku, której zwycięzcy reprezentują Polskę w międzynarodowym finale World Entrepreneur of the Year organizowanym co roku w Monte Carlo. To jedyna tej rangi, międzynarodowa inicjatywa promująca najlepszych przedsiębiorców.

EY Polska jest sygnatariuszem Karty Różnorodności i pracodawcą równych szans. Realizuje wewnętrzny program „Poziom wyżej bez barier”, aktywnie wspierający osoby z niepełnosprawnościami na rynku pracy. EY był w Polsce wielokrotnie wyróżniany tytułem „Pracodawca Roku®” w rankingu prowadzonym przez międzynarodową organizację studencką AIESEC. EY jest również laureatem w rankingach Great Place to Work oraz Idealny Pracodawca według Universum.