By Marek Grzybowski

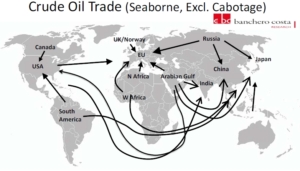

About 2.16 billion tonnes of crude oil were pumped through marine fuel terminals, of which the European Union’s marine terminals reloaded over 470 million tonnes in 2023. This result was surpassed by the economy of the People’s Republic of China, which imported 512 million tons by sea in the period January-December 2023, says Banchero Costa in the latest report. The Port of Gdansk is among the leading EU ports transshipping crude oil.

The war in Ukraine and disruption in supply chains made it another good year for oil trading companies. Demand for this energy raw material has increased despite high oil prices and the economic recession in many markets.

Despite the slowdown in many industrial and consumer markets, in the period January-December 2023, global transport of crude oil by sea increased by 5.3% y/y and reached 2,160.6 million tonnes, according to information based on data from observations of tanker traffic conducted by Refinitiv Maritime, excluding all cabotage trade.

In earlier years, global seaborne crude oil shipments were lower. In the period January-December 2022, they exceeded 2,050.9 million tons, and in 2021, 1,886.3 million tons were loaded onto tankers, while in 2019, 2,110.5 million tons were transported by sea between fuel terminals.

Persian Gulf – over 40% of global supplies

The dominant region and source of supplies is the Persian Gulf region. In the period January-December 2023, supplies from oil fields located in this region decreased by 1.4%. y/y to 869.1 million tons. Arab oil is still the dominant source of supply for many recipients, and recently also for Poland. Supplies from the Persian Gulf accounted for 40.2% of global maritime oil trade in 2023.

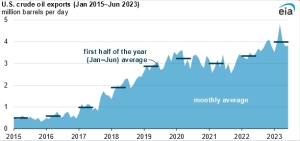

Exports from Russian ports increased in 2023 by 5% y/y to 229.5 million tons. This is 10.6% of the supply in global crude oil trade. From the USA, exports of this raw material increased by 19.5% y/y to 197.2 million tons. From West Africa, oil exports last year increased by 2.5% y/y and reached 174.8 million tons. Exports from South America increased by 20.8% y/y. and 157.6 million tons were loaded onto tankers. Exports from the oil fields of Northwest Europe increased by 3.4% y/y to 111 million tons.

China’s economy generated demand for 23.7% of global supplies

The largest maritime importer of crude oil in 2023 was the PRC. China’s economy generated demand for 23.7% of global supplies. Oil supplies to China increased in the period January-December 2023 by 16.6% y/y to 512 million tons, while a year earlier it was over 70 million tons less (439.9 million tons in 2022).

India’s imports increased by 1.9% y/y to 228.2 million tonnes. This means that India generates 10.6% of global demand. The South Korean economy imported +2.7% more in 2023 than the previous year. Fuel terminals pumped 140.4 million tons of crude oil from tankers. Japan reduced imports by 8.1% y/y. 121.6 million tons of crude oil were unloaded at the fuel terminals of Japanese ports.

The European Union is the second global importer

The European Union is the world’s second largest importer of crude oil by sea. In 2022, it overtook China. However, in the period January-December 2023, imports by sea to the European Union (27) increased at a rate four times lower than imports from China. It was only 4.7% y/y. As a result, tankers delivered 472.4 million tonnes to fuel ports in the EU. In 2023, the EU accounted for 21.9% of global crude oil trade.

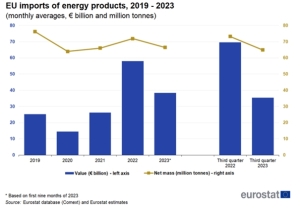

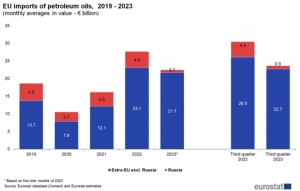

EUROSTAT points out that “the observed significant fluctuations in EU oil imports [Ministry of Economy] are a consequence of high price volatility. The share of crude oil [in value terms – Ministry of Economy] in total EU imports increased from 9.1% in 2021 to 11% in 2022 and decreased slightly to 10.6% in the first three quarters of 2023.

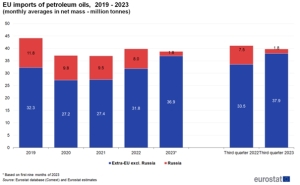

EU countries, including Poland, increased their imports of crude oil. In 2022, the economies of EU countries imported 388.8 million tons, a year earlier it was over 402.5 million tons, while in 2019 the EU needed 446 million tons of oil imported through fuel terminals.

Increased spending on oil imports

These volumes also translated into an increase in spending on crude oil imports. The average monthly import from Russia decreased in 2021-2022, but due to rising prices, the value of imports from Russia also increased (EUR 0.6 billion). Imports from other non-EU partners increased, which meant that EUR 10.9 billion more had to be paid for supplies, according to EUROSTAT. – In the first three quarters of 2023, the trend was reversed, and the total average values decreased by 19% compared to 2022 (from EUR 27.6 billion in 2022 to EUR 22.4 billion in Q1-Q3 2023 y.) – says EUROSTAT.

About 14% of the crude oil delivered to the EU by tankers in 2023 was transported on VLCCs, about 43% arrived on Suezmax tankers and about 42% was offloaded from Aframax ships, reports Banchero Costa Research.

Rotterdam was the port with the largest volume of received oil delivered to the EU. In 2023, 101 million tons of crude oil reached the refineries located in its zone by sea. In second place was the Northern Port in Gdańsk, whose terminals pumped 37.6 million tons (in 2022 – 25.5 million tons).

– Naftoport has become an oil hub for the region. It is through the Gdańsk fuel terminal that the refining needs of both Poland and our closest neighbors are secured. Naftoport last year reloaded a total of 36.6 million tons of crude oil and fuels. Part of this cargo is supplies to German refineries. After cutting off supplies via the “Przyjaźń” oil pipeline from Russia, Poland became the most important gateway for them, informed the Port of Gdansk Authority.

In third place is the seaport of Trieste, to which tankers delivered 36 million tons. Next are the fuel terminals in Fos (22.0 million tons), Le Havre (19.3 million tons), and Wilhelmshaven (17.9 million tons). The following ports handled less than 15 million tons in 2023: Cartagena (14.3 million tons), Sarroch (12.2 million tons), Augusta (11.4 million tons), Algeciras (10.2 million tons), Tarragona (9, 8 million tons), Lysekil (9.5 million tons).

Turbulences in crude oil logistics

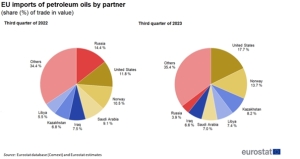

European Union countries have been hit hard by the turmoil in crude oil logistics. Ship deliveries had to replace pipeline transport. It was necessary to change the countries and ports from which oil was imported in 2023. Not everything went as expected and holes appeared in the sanctions through which oil from Russia leaked.

However, changes in logistics chains have changed transshipment in many countries and ports, both on the export and import side. In the period January-December 2023, supply from Russian ports (including Kazakh oil) decreased by 40.4% y/y compared to 2022 and 47.9% compared to 2021 compared to 2021. In 2023 58.6 million tons were exported through Russian terminals, while in the previous year it was 98.4 million tons, and in 2021 112.5 million tons.

Ukrainian drone attack on the ports of St. Petersburg and Ust Luga caused the Governor of the Leningrad Oblast, Aleksandr Drozdenko, to announce an alarm for ports in January and introduce the highest level of threat to critical infrastructure facilities. The alarm was announced in all areas of the oblast. In particular, it applies to terminals with installations located in the ports of Vyborg, Vysotsk and Primorsk.

Currently, Novorossiysk is the largest port exporting crude oil to the EU. In 2023, it amounted to 47.4 million tons. Russian ports have dropped in the ranking of oil suppliers to the EU over the last 2 years. However, they are the fourth supplier of crude oil to the EU transported by sea.

USA, Norway and Great Britain in the oil gap after sanctions

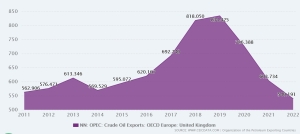

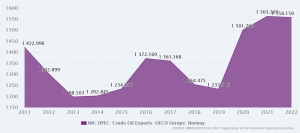

This is only 12.4% of the volume in the period January-December 2023. British and Norwegian oil from the North Sea accounted for last year. 18.6% of deliveries to the EU. Production companies from North Africa provide 17.3% of supplies, and 15.4% of the oil imported by EU countries arrives from the USA via tankers.

As a result of the sanctions imposed on Russian oil, supplies to the EU from the North Sea (Norway and Great Britain) increased by 14% year on year. In the period January-December 2023, 87.8 million tonnes arrived by tankers from British and Norwegian offshore drilling to EU ports.

Imports from North Africa (including Sidi Kerir) increased by 17.3% y/y to 81.7 million tonnes in January-December 2023. Imports from the US increased by 41.5% y/y, reaching a new record all-time amounting to 72.8 million tons.

Supplies from West Africa to Europe increased by 8.2% y/y to 54.4 million tonnes in 2023. Direct supplies from the Persian Gulf also increased sharply. In 2023, the supply dynamics reached 32.2% y/y to 45.3 million tons. The volume of deliveries from Turkey (Ceyhan) decreased by 32.7% y/y to 23 million tons from 34.2 million tons in January-December 2022.

The sanctions imposed on Russia have resulted in a significant decrease in direct imports of Russian oil to the European Union. Now the country’s oil comes indirectly through operators and traders using “gray” or “black” fleets.

Transfer ports are also cleverly used, where oil from ships carrying Russian oil is transferred to ships operating on official registers. STS operations – pumping oil in bays or in port roadsteads – are also common.

Russian oil also reaches EU ports in the form of products produced in refineries of third countries that have not imposed sanctions. And so, thanks to leaking sanctions, oil from Russia reaches European Union ports.