|

|---|

|

|---|

|

|---|

|

|---|

|

|---|

|

|---|

|

|---|

|

|---|

|

|---|

|

|---|

The aftermaths of COVID and the attack on Ukraine has created huge waves of uncertainty and instability all over the world and anyone operating internationally is affected by geopolitical upheavals and the years ahead will focus on zero emissions and climate neutrality. The maritime business is indeed very complex, dynamic and fast evolving, which in turn makes an arena like Nor-Shipping very important. Nor-Shipping is a world leading arena, where cutting edge Norwegian and international companies showcase the innovations that deliver competitive advantage for their customers. Nor-Shipping’s partnership with WISTA is a key contributor in our effort to raise awareness of the challenges and the many great opportunities for women in shipping. Ocean Campus is an important part of the Nor-Shipping. It is a dedicated island of exhibition booths showcasing some of the world’s leading maritime universities and colleges. Leading Ocean Campus Partner is the World Maritime University (WMU).

Marek Grzybowski: Maritime business today is shipping, ports and logistics, oil and gas production, offshore wind farms, fish and seafood production, it is sea tourism and exploration, it is science and education, it is a large area of creating innovation, it is a specific community of people, business and people who love the oceans, they are partners in business, science and environmental protection. Can you briefly characterize the Nor-Shipping event?

Sidsel Norvik, Director, Nor-Shipping: Nor-Shipping is a world leading arena, where cutting edge Norwegian and international companies showcase the innovations that deliver competitive advantage for their customers. It is the place where the maritime, tech, finance and wider business segments cross paths to learn from one another, forge partnerships, and access new economic value creation.

The 22,000 m2 exhibition space is the beating heart of the week’s activity. This is where delegates and visitors can experience the products, services and companies that will help drive a new age of ocean industry development. Spiced with a lot of topical conferences and a dynamic after work festival, Nor-Shipping provide an invaluable combination of insight, business opportunities and social networking.

Marek Grzybowski: The maritime business is extremely complex, currently developing in close connection with IT, AI, space technologies, VR and IoT. What is the concept of presenting the business sector, science and companies just entering the maritime business in exhibition halls?

Sidsel Norvik, Director, Nor-Shipping: The maritime business is indeed very complex, dynamic and fast evolving, which in turn makes an arena like Nor-Shipping very important. Just by walking the isles, you get to experience the latest innovation and technology from a wide range of maritime segments and countries – all in one place.

You can also attend the Blue Talks, Technical seminars and the Offshore Aquaculture conference for free and you can upgrade your ticket with a small fee to join the 2nd Maritime Hydrogen Conference, the 1st Offshore Wind Conference, the 4th Int. Ship Autonomy and Sustainability Summit and a lot more. The program is vast and easily available to plan your participation.

Marek Grzybowski: Nor-Shipping is an opportunity to present the latest achievements in science and technology. However, the context in which the maritime economy functions cannot be avoided. Russia’s attack on Ukraine clearly affected the conditions for the functioning of the maritime economy. Nor-Shipping has confirmed that Joseph E. Stiglitz, the renowned Nobel laureate in Economics and former Chief Economist at the World Bank, will be a keynote speaker at this year’s Ocean Leadership Conference, taking place in Lillestrøm, Norway, 6 June. The war on land caused significant changes in the operation of maritime business. Do you expect this topic to come up during the 2023 Nor-Shipping Ocean Leadership Conference?

Sidsel Norvik, Director, Nor-Shipping: The aftermaths of COVID and the attack on Ukraine has created huge waves of uncertainty and instability all over the world and anyone operating internationally is affected by geopolitical upheavals and the years ahead will focus on zero emissions and climate neutrality. All in all a challenging landscape to navigate in. This year’s Ocean Leadership Conference will bring together high-profile international leaders, from the ocean industries and beyond, to ask how we can move forward towards collective goals, and individual business ambitions.

Together we will assess if partnerships between maritime players, energy suppliers, financial institutions, authorities and other central stakeholders holds the key to unlocking the energy transition and decarbonisation of shipping. The future will not be defined by individual companies, or isolated breakthroughs, but rather by how we move together for a profitable tomorrow.

Marek Grzybowski: The role of women in the maritime business is growing. WISTA Norway is a partner of Nor-Shipping. WISTA Norway launched ‘40 by 30’ Pledge to allow the maritime company to show that the company actively commit to promoting diversity in the maritime industry. Do you anticipate special businesswoman activity during meetings in 2023?

Sidsel Norvik, Director, Nor-Shipping: To improve conditions for women in shipping and increase number of women across the maritime industry is important. Nor-Shipping’s partnership with WISTA is a key contributor in our effort to raise awareness of the challenges and the many great opportunities for women in shipping.

Nor-Shipping has of course also signed the “40 by 30” pledge and urge others to follow. WISTA Norway is 35 years this year and will celebrate with a Leadership Award ceremony. They will also present “10 women to watch” together with YoungShip and execute their “Waves of change” program, which will be a series of topical session at the Blue Talk stage in Hall E.

Marek Grzybowski: Nor-Shipping launches Ocean Campus in partnership with World Maritime University. This is a new initiative. What is the mission of this event? What other events important for the maritime business will accompany Nor-Shipping 2023?

Sidsel Norvik, Director, Nor-Shipping: Ocean Campus is a dedicated island of exhibition booths showcasing some of the world’s leading maritime universities and colleges. Leading Ocean Campus Partner is the World Maritime University (WMU) and other Campus members include the Norwegian University of Science and Technology (NTNU), BI Norwegian Business School, UiT The University of the Arctic (UArctic), MLA College, Oslo MET, Alba Graduate Business School and SINTEF Ocean.

These universities and colleges represent a solid geographical spread and a wide range of maritime industry competency. Together they will form an Ocean Campus Committee of industry experts to tailor an exciting program for the main Ocean Campus day on Friday 9 June. The mission is to demonstrate how academia is adjusting to the maritime transition and what maritime career opportunities are in store for the next generation. We will stream this event to allow students and next generation shipping employees to get access from wherever they might be.

Marek Grzybowski: Thank you for your answers

By Marek Grzybowski

With Russia’s invasion of Ukraine, new players appeared on the maritime transport market. The demand for used tankers has increased, which has driven freight rates up after a long period of stagnation, and this has encouraged new players to enter the market dynamically.

Trading in old tankers has become an opportunity to do business and support crude oil trading on new routes. As always, war drives business to those who take advantage of the opportunity. The turmoil in the oil transportation market has meant that sellers and buyers, tanker operators and oil suppliers profit from the war.

The sanctions imposed on trade in Russian oil and petroleum products, which entered into force in December 2022 and February 2023, increased the activity of tanker operators and allowed new players to enter the market. Some of them are pointed out by Rebecca Galanopoulos Jones, who runs the VV blog.

As a result, with the continued demand for oil and the slowdown in supply via pipelines to recipients in Europe, oil streams began to flow through the sea instead of via pipelines. Oil exports from the Arabian Gulf increased by 12.8% y/y to 880.1 million in 2022 and accounted for 42.9% of global oil trade by sea.

Exports from Russia also increased by 10.4% year on year to 218.7 million tonnes and accounted for 10.7% of the global supply of this raw material. The US increased supply and exports increased by 22.9% year-on-year to 165.1 million tonnes, according to Bancosta in its latest report.

“We are looking at new and opportunistic players that have entered the tanker market. We analyze what they bought and what impact this had on the respective market values, especially as the demand for older ships continues to grow,” emphasizes Rebecca Galanopoulos Jones, VV blogger.

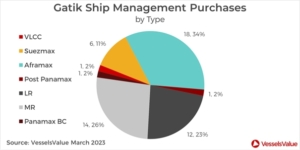

“Gatik Ship Management, based in India, is one of the most interesting companies to emerge in the last 18 months,” remarks Rebecca Galanopoulos Jones.

Previously unknown on the maritime transport market, the entity has recently acquired a significant number of ships and as of December 2021 has been operating 53 tankers with a tonnage of over 37,000. up to 318 thousand two tues It has an average age of 17 and a total market value of $1.5 billion.

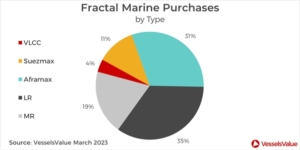

Fractal Marine Shipping is another new player in the market that has been noticed by Rebecca Galanopoulos Jones of VesselsValue. The shipowner has grown rapidly over the past year. Fractal is based in Geneva and registered in the United Arab Emirates. The operator manages a fleet of tankers. As of March 2020, the company has built a fleet of 27 ships, of which 26 have been purchased since May 2022. Recently purchased ships are between 9 and 14 years old.

Radiating World Shipping Services, headquartered in the United Arab Emirates, purchased its first vessel in December 2022 and has since acquired a total of 12 tankers, including 6 Aframaxes and 6 MRs, with an average age of 17 years.

More: VesselsValue Blog, Winword, Revinitiv, Bancosta Research; War on land, business at sea GospodarkaMorska.p

By Marek Grzybowski

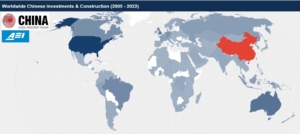

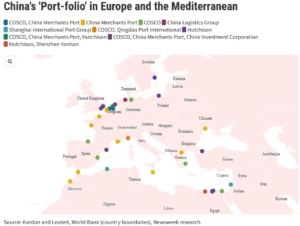

Chinese companies were involved in 147 countries with an estimated amount of USD 67.8 billion through financial investments and contractual cooperation under the Belt and Road Initiative (BRI) in 2022. This is slightly less than China’s involvement in BRI in 2021, which amounted to USD 68.7 billion, according to data from the Ministry of Commerce of the PRC.

Approximately USD 32.5 billion was allocated to direct investments, and USD 35.3 billion were construction contracts, which were partly financed by Chinese loans. Following the Covid-19 pandemic, China’s investment exposure in international markets has shown steady growth since 2020.

Cumulative investments under the BRI since the announcement of the BRI in 2013 amounted to USD 962 billion, of which approximately USD 573 in construction contracts and USD 389 in non-financial investments, enumerates Dr. Christoph Nedopil Wang, director and founder of the Green Finance & Development Center, associate professor at Fanhai International School of Finance (FISF) at Fudan University in Shanghai.

China’s average investment deal size increased from around US$444 million in 2020 and US$476 million in 2021 to US$650 million in 2022. This is the highest value since 2019. Compared to the peak in 2014, the investment deal volume is 21% smaller. In the case of construction projects, the transaction volume in 2022 was the lowest since the announcement of the BRI in 2013, as it decreased to USD 321 million compared to USD 530 million in 2021 and USD 386 million in 2020, according to data from the Ministry PRC Trade.

China’s investment involvement in BRI focuses on the energy sector (36% of expenditures) and the manufacturing sector for transport (18%), which, compared to 2021, is an increase in the total value by 60%. This is a continuation of the previously adopted strategy. This was noticeable in 2021.

Chinese involvement related to the energy sector accounted for the bulk of China’s BRI spending. In 2021, the total exposure in the energy sector was approximately USD 22.3 billion. This compares to an exposure of over USD 26.1 billion in 2020 and almost USD 44.8 billion in 2019. In 2021, the majority of investments in the energy-related sector concerned oil processing (31%), followed by use of solar and wind energy (31%) and gas (22%).

Source; Lommes – Own work, CC BY-SA 4.0, https://commons.wikimedia.org/w/index.php?curid=58884083

Source; Lommes – Own work, CC BY-SA 4.0, https://commons.wikimedia.org/w/index.php?curid=58884083

More: Investments on the Silk Road GospodarkaMorska.pl

The Blue Maritime cluster is a National maritime cluster mandated by the Royal Ministry of Trade, Industry and Fisheries to accelerate innovation within the maritime supply chain. The cluster companies total revenues are estimated to 58 bn NOK in 2023 against 54 bn in 2022. Our export share is 50% on average divided between yards (NOK 2.5 bn), shipping companies (3.3 bn), services (6.7 bn) and equipment suppliers (11.1 bn).

New Blue Deal, launched in june 2021, where we take aim on becoming the first zero emission maritime cluster in the world. Many initiatives around the world are looking at new green alternative fuels and energy to run the ships of tomorrow. We look at the energy sources. Yes they must be low and zero emission. How do we produce them, harvest them and how do we establish an infrastructure for them? Furthermore we look at the energy consumption in the vessels. Not only engines and generators, but the complete consumption of energy that goes into a ship. Where can we save?

Through our work in R&D and competence elevation, we are determined to develop a complete green newbuilding program, a green refit program and a circular value chain for decommissioning – all based on the New Blue Deal directions.

Marek Grzybowski: Please, describe the fields in which the Cluster operates? In which region of Norway are the companies operating in the cluster concentrated?

Daniel Garden, CEO, Blue Maritime Cluster:

The Blue Maritime cluster is a National maritime cluster mandated by the Royal Ministry of Trade, Industry and Fisheries to accelerate innovation within the maritime supply chain. We facilitate R&D projects, pre-studies, competence project and analysis activities in order to provide the participants with market intelligence and knowledge within commerce, technology or methodology. The geografical concentration of this industry is highest in the region between Trondheim and Bergen on the west coast.

Marek Grzybowski: In 2014, due its unique global market position and its important contribution to Norwegian value creation, the cluster was granted the status of a Global Centre of Expertise. What role does Blue Maritime Cluster play in the green transition?

Daniel Garden, CEO, Blue Maritime Cluster:

I would start with mentioning the even more important cluster strategy, New Blue Deal, launched in june 2021, where we take aim on becoming the first zero emission maritime cluster in the world. Many initiatives around the world are looking at new green alternative fuels and energy to run the ships of tomorrow. To us, the ships of tomorrow must also require far less energy to operate in order to accommodate reduced energy concentration or other scarcities accompanied with alternative energy sources. Looking at both these topics simultaneously, we believe we can arrive at the goal faster. Combining this work with the unique position and skills our cluster has within maritime innovation, we believe we will succeed.

Marek Grzybowski: What does the cluster build its competitive advantage on? What tasks related to raising the level of innovation does the cluster focus on? What technologies, solutions and businesses of the future are being developed. What projects are implemented by the cluster?

Daniel Garden, CEO, Blue Maritime Cluster:

We base our projects and competence development around the idea of the full supply chain is constantly challenging the established methods and technologies. By being the first with the latest solutions, we can compete against larger and/or cheaper regions of the world. I believe the entire European cluster would benefit from chasing such a position, actually.

As the whole maritime community of companies, research and universities, risk capital, public bodies and entrepreneurs are all represented in the cluster, we are also able to address the challenges, like zero emission. Our strategy on zero emission starts with the ship operations and looking at how they can become more efficient. The least polluting miles are the ones you never sail.

Then we look at the energy sources. Yes they must be low and zero emission. How do we produce them, harvest them and how do we establish an infrastructure for them? Furthermore we look at the energy consumption in the vessels. Not only engines and generators, but the complete consumption of energy that goes into a ship. Where can we save?

Moving on to smart use of energy, we look at how to develop methods and technologies that will let us use the energy over and over again. It can be heat recovery, regeneration on winches and more.

In an extended view, we will not succeed in net zero before we also look at the building and scrapping processes of the vessels. How can we build emission free? What new supply chains must be established? It is all very exciting work, I must admit.

Marek Grzybowski: The Steering Committee operates in the Cluster. What is its mission, what are its tasks, what is its role in creating development directions, projects and business activities? What are the most important directions for the development of the maritime business for the Møre maritime cluster?

Daniel Garden, CEO, Blue Maritime Cluster:

The Steering Committee is our board that oversees the cluster’s administration and strategic progress. Our development directions are formed on the basis of our strategy where the companies themselves initiate the topics on which to focus on. Our activity is dependent on the companies involving themselves in the projects, spending their time and money on them. So to reach a high level of committment we also need the projects to be relevant to the participants.

Through our work in R&D and competence elevation, we are determined to develop a complete green newbuilding program, a green refit program and a circular value chain for decommissioning – all based on the New Blue Deal directions.

Commercially, the Norwegian market is too small for us, and as export always has been an important part of the cluster’s revenues, developing the export is also an important foundation for our work.

Marek Grzybowski: The high level of the offer of innovative technologies results in a high level of revenues of companies operating in the Cluster in the Møre region. What is the overall revenue for the four main segments in Møre region in 2020-2022? What are the prospects for 2023? What is the share of export revenues? What is the future export potential for the maritime companies in the Møre region? What are Cluster export opportunities and barriers?

Daniel Garden, CEO, Blue Maritime Cluster:

The cluster companies total revenues are estimated to 58 bn NOK in 2023 against 54 bn in 2022. Our export share is 50% on average divided between yards (NOK 2.5 bn), shipping companies (3.3 bn), services (6.7 bn) and equipment suppliers (11.1 bn).

The governent has an ambition for 50% increase of export by 2030. Our cluster will be well prepared to take our share from the segments within ocean based energy, ocean based food and ocean based travel.

Marek Grzybowski: Thank you for your answers