To mark The Boston Consulting Group’s fiftieth anniversary, BCG’s Strategy Institute is taking a fresh look at some of BCG’s classic thinking on strategy to explore its relevance to today’s business environment. This second in a planned series of articles examines the experience curve, an idea developed by BCG in the mid-1960s about the relationship between production experience and cost.

The experience curve is one of BCG’s signature concepts and arguably one of its best known. The theory, which had its genesis in a cost analysis that BCG performed for a major semiconductor manufacturer in 1966, held that a company’s unit production costs would fall by a predictable amount—typically 20 to 30 percent in real terms—for each doubling of “experience,” or accumulated production volume. The implications of this relationship for business, argued BCG’s founder, Bruce Henderson, were significant. In particular, he said, it suggested that market share leadership could confer a decisive competitive edge, because a company with dominant share could more rapidly accumulate valuable experience and thus achieve a self-perpetuating cost advantage over its rivals.

The experience curve theory proved a valuable descriptor and predictor of competitive dynamics across much of the business landscape through the 1970s, providing a sound guide for investment and pricing decisions and an invaluable tool for strategists. Is the idea applicable to today’s environment? Yes, but in some industries it is no longer sufficient by itself as a blueprint for competitive advantage. In contrast to the 1960s and 1970s, when the general business environment was relatively stable and new-product introduction relatively infrequent, today’s business climate is characterized by higher volatility, less stable industry structures, and frequent product launches in response to rapidly changing technologies and tastes.

Experience of the type addressed by the experience curve is still necessary—often critically so, depending on the industry. But we argue that most companies today need an additional kind of experience if they hope to create and sustain competitive advantage.

Two Types of Experience

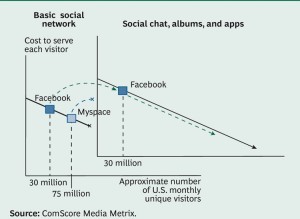

The type of experience that the classic experience curve refers to—the ability to produce existing products more cheaply and deliver them to an ever-wider audience—can be considered experience in fulfilling demand. This type of experience remains very important in many industries, especially those that are relatively stable, cost-sensitive, competitive, and production-intensive.

Experience in shaping demand—which can be gauged by a company’s product-introduction “clock speed” or by the percentage of sales derived from new products or services—can be a powerful competitive weapon, particularly when paired effectively with experience in fulfilling demand. It can be seen as a second-order type of experience, one that comes from sharing experience across different areas and learning how to learn new things. It includes the ability to “forget” lessons from the past when such information has become obsolete and is no longer relevant to the latest product generation. This type of experience can be disruptive not only because it involves innovation but also because being at a disadvantage on an earlier product generation can quickly be overturned by shaping demand to get a head start on the next experience curve.

…

Solidifying your long-term competitive advantage in today’s environment requires asking yourself a series of questions about excellence in both shaping and fulfilling demand.

What balance of experience in fulfilling and shaping demand is required in our industry?

Do we have the right disciplines and capabilities to develop and leverage experience in fulfilling demand?

Do we have the right disciplines and capabilities to develop and leverage experience in shaping demand?

Do we have the right metrics in place for both types of experience?

Do we have the right approach to balancing and combining experience types?

by Martin Reeves, George Stalk, and Filippo L. Scognamiglio Pasini

Authors: Martin Reeves, Senior Partner & Managing Director, New York; George Stalk, Senior Advisor, Toronto; Filippo L. Scognamiglio Pasini, Principal, New York

The authors thank Bruce Henderson and the many other BCG employees for their original work on, and subsequent development of, the experience curve; our clients, who worked with us to advance the theory and continue to do so; and BCG’s Strategy Institute team and its collaborators, especially Carine Assouad, James Hollingsworth, Jussi Lehtinen, and Carolyn Young, for their help in pushing BCG’s current thinking forward. Valuable input was provided by all BCG employees who submitted essays on this topic and by those who helped in its early, exploratory stage—in particular, Aakash Arora, Hannah Chang, and Max Otto.

More: BCG Strategy Institute