The rich are getting richer, but the not-as-rich are slowly catching up. Those are the two key messages of the 2015 BCG e-Intensity Index, a tool that measures the maturity of 85 Internet economies. The index includes all 28 members of the EU, most of Latin America and Asia, and 14 African countries.

Since the publication of our first index, in 2011, the scores of the BRICI (Brazil, Russia, India, China, and Indonesia), Latin American, and African countries have risen annually by 27%, 21%, and 21%, respectively. But given their relatively low starting positions, those economies will not catch up anytime soon to the EU15 or G7 countries, whose scores have been rising by 16% and 14%, respectively. Thailand and China improved their rankings the most. Thailand moved up 12 spots, to sixty-second place, while China rose ten spots, to thirty-fifth.

The index consists of three components:

- Enablement accounts for 50% of the total weighting; it measures various aspects of fixed and mobile infrastructure deployment.

- Engagement, which accounts for 25%, measures how actively businesses, governments, and consumers are embracing the Internet.

- Expenditure, also accounting for 25%, measures the proportion of money spent on online retail and advertising.

Enablement and expenditure have powered the overall rise in index scores, while engagement has stagnated. E-commerce has become so prevalent and popular in China that it now has the fourth highest score on the expenditure component, after the UK, South Korea, and Denmark.

As one might expect, wealthy nations from northern Europe dominate the top of the index. Denmark emerged as the leading overall Internet economy, supplanting South Korea, which fell three spots. South Korea is now bracketed between Luxembourg and Sweden (above) and the Netherlands, Norway, and the UK.

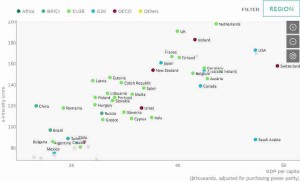

More intriguing, however, are the economies that are performing better than their economic profiles would suggest. Many of the countries in Central and Eastern Europe—Latvia, Estonia, Poland, and Lithuania for example—fall into that category when e-Intensity is compared with per-capita GDP on the basis of purchasing-power parity. Many of the Latin American economies, on the other hand, are underperforming.

More: www.bcgperspectives.com