Data and digitization are creating a growing array of value-creation choices in industries as diverse as pharmaceuticals, mining, and energy.

During the 1980s, McKinsey’s Fred Gluck and Harvard Business School professor Michael Porter began writing about the interrelated activities through which companies create value for their customers. Executives have always had choices about how to perform the activities in this “business system” (Gluck’s words) or “value chain” (Porter’s). In the digital age, as information disrupts the nature of value creation in many industries, the range of choices available to senior business leaders has increased. For example, digital platforms in the pharmaceutical industry now make it possible to aggregate massive amounts of data on diseases—potentially accelerating the discovery and design of new drugs and challenging the industry’s legacy processes. In energy production and mining, although companies have long outsourced some functions in efforts to drive down costs, digital requires a new approach. Using data, suppliers can offer incumbents an expanded range of capabilities and productivity gains—alluring possibilities that are accompanied by the risk that sharing too much data could shut off areas of future growth. This type of flux in value chains will only intensify across industries, forcing leaders to grapple with existential questions about core competitive strengths in an environment where destabilizing technologies will be the norm.

Will digital platforms transform pharmaceuticals?

Start-up companies are combining genetic information and new therapies to transform drug discovery and development—at greater speed and scale.

Product innovation is at the heart of the pharmaceutical industry’s value chain. Long, capital-intensive development cycles and legacy processes, though, have made it difficult to exploit the full potential of emerging digital technologies to deliver faster, more agile approaches to discover and develop new drugs. Indeed, McKinsey research shows that the industry’s digital maturity lags that of most other industries.

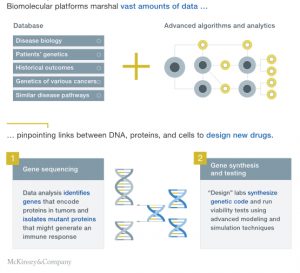

A new current is forming in one area of the industry: start-up companies that are creating biomolecular platforms around cellular, genetic, and other advanced therapies.1 The platforms marshal vast amounts of data on the genetics of diseases, such as cancer, and combine that with patients’ genetic profiles and related data. They zero in on key points along the information chain—for example, where there are linkages between DNA and proteins, and then cells—to “design” new drugs. Much like software developers, the platforms engineer disease therapies built upon the “code-like” DNA and RNA sequences within cells (Exhibit 1).

These techniques have significant implications for the treatment of many life-threatening illnesses that are outside the reach of standard therapeutic approaches. They could also disrupt the industry’s value chain as they speed up drug discovery and development, with the potential for a single platform to scale rapidly across a range of diseases (Exhibit 2).

In one example of a biomolecular platform, for a disease that results from a mutation in DNA that codes for a needed enzyme, the platform models the disease from medical and genetic data to arrive at an enzyme “optimized” to correct for the mutation. The platform then designs a sequence of genetic material to treat the disease, as well as a delivery vehicle to get it to the target cells. In another example, for CAR-T2 therapies, the platform modifies a patient’s T cells (an immune-system cell), which are then deployed to attack a cancer.

A new competitive landscape

Optimized biomolecular platforms have the potential to accelerate the early stages of R&D significantly. For example, it can take as little as weeks or months to go from concept to drug versus what’s often many months, if not years, of trial and error under conventional discovery methods. This is achieved by routinizing key steps (such as preparing a drug for preclinical testing) and using common underlying elements in the design of the drug (such as drug-delivery vehicles that are similar). In the past five years or so, a number of start-ups have formulated dozens of drugs that are in clinical trials and, in some cases, drugs that have already been approved. The large information base behind therapies helps identify the right targets for preclinical and clinical trials.

…

By Olivier Leclerc and Jeff Smith

More: https://www.mckinsey.com