Pundits have been buzzing in recent months about the slowdown of China’s economic juggernaut. There is evident cooling of GDP growth, especially since the middle of last year, and sales of cars and smartphones have been dropping steeply. Some high-profile companies are flashing warnings of plunging sales and some even of job cuts.

Yet, despite the doom and gloom China continues to rack up one of the most enviable growth rates in the world, adding the equivalent of “another Australia” each year. Consumers continue to trade up to more expensive premium goods and some companies are registering record sales. So the gloom is not uniform. What do the facts tell us about what to expect in 2019? In this first edition of China Brief, we take a quick look at some of the key drivers shaping China’s economy today.

1. Growth is slowing—but China is still adding the equivalent of Australia every year

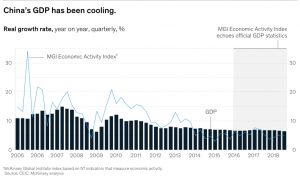

Economic activity weakened in 2018: Official statistics placed real GDP growth at 6.6 percent in 2018, the lowest rate since 1990. While some observers may challenge the precision of the official numbers, this much is true: The Chinese economy is slowing. The McKinsey Global Institute’s Economic Activity Index, which tracks the performance of the Chinese economy by looking at a basket of 57 different indicators ranging from retail and property sales to electricity consumption, echoes the dipping trend line in China’s official GDP numbers (Exhibit 1).

The Economic Activity Index takes a broad set of factors into account and has fluctuated more than raw GDP over the last decade, rising higher than GDP in the double-digit period from 2005-2008, and then again from 2010-13. The Index has been lower than GDP for the last four years, and currently hovers at levels similar to 2015-16, when there were similar fears of a hard landing for China’s high growth economy.

The economy is expected to continue to soften in 2019, with consensus forecasts expecting GDP growth to land somewhere between 6.0 and 6.2 percent this year.

Yes, China’s economic engine is cooling down, yet it continues to rack up one of the fastest rates of economic growth in the world. Given its enormous scale, this translates into substantial additions in absolute terms: This year, China will add the equivalent of the entire Australian economy to its GDP.

By Nick Leung, a senior partner in McKinsey’s Hong Kong office.

More: www.mckinsey.com