Retail supply chains are grappling with the humanitarian impact of the outbreak, as well as new operational risks. Five actions can help retailers bring goods to communities and help employees.

As the coronavirus outbreak has spread and its humanitarian impact has grown, retailers have stepped up their efforts to provide consumers with essential goods and to protect the health and well-being of the communities they serve. Particular challenges have arisen in global retail supply chains, where the pandemic’s far-reaching effects have weighed heavily on the health and well-being of employees and jeopardized livelihoods and economic lifelines in many communities.

Retailers are now taking extraordinary measures to keep goods moving to store shelves and consumers’ doorsteps. Supply-chain leaders are creating transparency and building rapid-response capabilities to mitigate the short-term fallout from the crisis. We focus in this article on the five actions retailers are taking to resolve the immediate challenges that COVID-19 presents to supply-chain workers, business partners, and operations. (In a subsequent article, we will examine how supply-chain leaders at retail companies can chart a path to the next normal, building resilience and returning the supply chain to full effectiveness while reimagining and reforming supply-chain operations to improve their performance.)

Changes in consumer spending during the outbreak

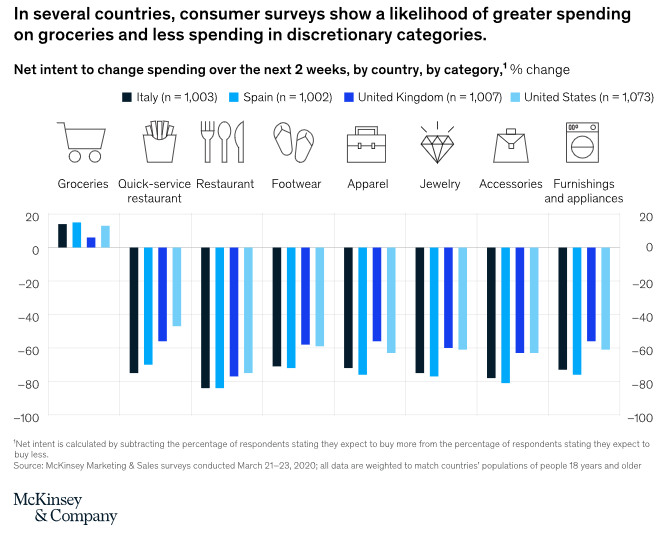

Retailers’ supply-chain difficulties have largely arisen as big shifts in consumer behavior and stepped-up health restrictions have rippled back through their operations. One noteworthy shift has been an abrupt swing in purchasing patterns. Sales of nondiscretionary products, such as food, household, and personal-care products, have spiked, while sales of discretionary items, such as apparel and furnishings, have tailed off. Our consumer research indicates that these initial shifts could persist in the very near term—though it remains to be seen how the restrictions that some governments have placed on store openings and order deliveries might further influence consumer behavior. In recent McKinsey surveys of consumers in Italy, Spain, the United Kingdom, and the United States, respondents were more likely to say that they would increase their spending on groceries than to decrease it during the next two weeks. For most discretionary consumer-spending categories, including restaurants, apparel, and furnishings, respondents were more likely to say they would decrease spending (Exhibit 1).

We strive to provide individuals with disabilities equal access to our website. If you would like information about this content we will be happy to work with you. Please email us at: McKinsey_Website_Accessibility@mckinsey.com Consumers have also said they will shift spending among channels. In the surveys noted above, McKinsey asked consumers whether they were planning to increase or decrease their in-store and online spending on various types of goods during the next two weeks. Only respondents in Italy and Spain said they were likely to increase their in-store spending on nondiscretionary goods, such as groceries and household supplies. Respondents in the United Kingdom and the United States, by contrast, were more likely to say they would increase their online spending on groceries and household items. And respondents in all four countries said they were likely to increase their online spending on a wider variety of items

How retail supply chains are adapting: Five priority areas

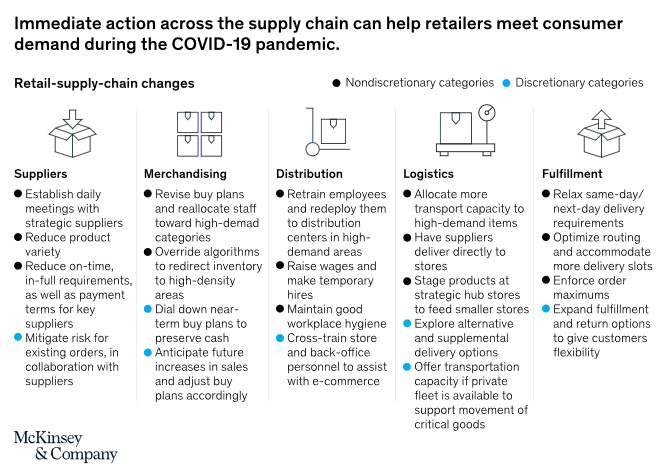

The pandemic has forced retail executives to mount urgent efforts to adapt their supply chains, whether by revising their purchase orders and merchandising plans or by reallocating all kinds of resources—working capital, inventory, employees, transport capacity—to where they are needed most (Exhibit 2). We explore these changes in detail below.

About the authors: Manik Aryapadi is an associate partner in McKinsey’s Cleveland office; Vishwa Chandra is a partner in the San Francisco office; Ashutosh Dekhne is a partner in the Dallas office; Kenza Haddioui is a partner in the Paris office; Tim Lange is a partner in the Cologne office; and Kumar Venkataraman is a partner in the Chicago office.

More: www.mckinsey.com