There is opportunity in adversity in every business. It may seem callous to stress opportunity in the midst of a humanitarian crisis, but leaders have an obligation to look ahead, to anticipate and meet new customer needs, to evolve their strategies and organizations, and in so doing sustain the prosperity of their enterprises.

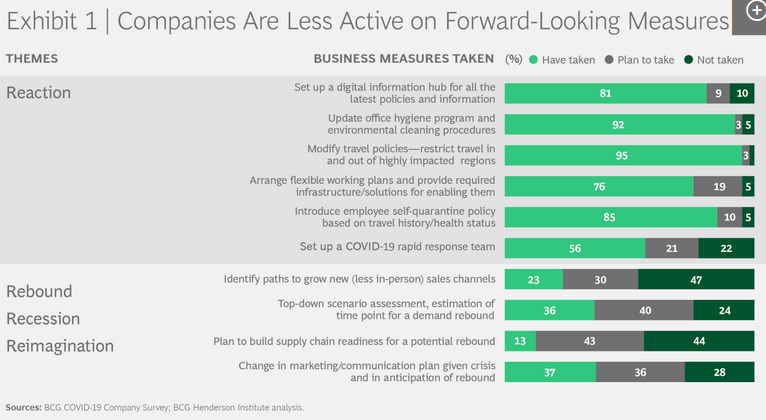

We should not expect that the resolution of the COVID-19 pandemic will be a return to a 2019 reality. For example, SARS is credited with being one of the accelerators for the adoption of e-commerce in China and the rise of Alibaba. Many organizations are understandably focused on reacting to and coping with the short-term challenges presented by the unfolding epidemic. (See Exhibit 1.) But in addition to reaction, they need to focus on three more important Rs: rebound, recession, and reimagination. Beyond individual companies, there is also an opportunity for society as a whole to reimagine norms, behaviors, and platforms for coordination and collaboration.

A rebound of demand is inevitable, and using high-frequency data proxies for the movement of goods and people, production, and confidence, we can see that it is already beginning to happen in China. (See Exhibit 2.) Given the complexity of rebooting companies and supply chains at different speeds in different places, the time to begin preparing a rebound strategy is now. Over the past 100 years, epidemics have only temporarily deflected the economic cycle with short, sharp shocks. Of course, this time could be different. A bear market (technically, a 20% decline) does not guarantee a recession but indicates a high probability of one. The most recent expansionary cycle has been one of the longest in recent economic history, and signs of vulnerability were already showing in trade relations, political instability, corporate debt, and other areas. The shock to demand and confidence could easily tip the global economy into a recession.

Prudent companies will prepare for this possibility. Our analysis shows that 14% of companies across all sectors actually grow top and bottom lines during recessions and downturns. Those that flourish share the common traits of preparation, preemption, growth orientation, and long-term transformation. They take a long-term view and place growth bets when competitors are retrenching. And even after the epidemic recedes, and even in the case of recession, there will be opportunities and needs to reimagine business and operating models and also the portfolio of offerings. For the average company, the first casualty of a crisis is imagination. But those that shape and benefit from the future will be those that can imagine it.

More: https://www.bcg.com/pl-pl/

Authors: Martin Reeves, Managing Director & Senior Partner, Chairman of the BCG Henderson Institute, San Francisco; Lars Fæste, Managing Director & Senior Partner, Hong Kong; Kevin Whitaker, Economist, New York; Mark Abraham, Managing Director & Senior Partner, Seattle