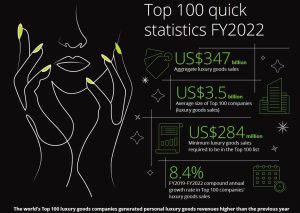

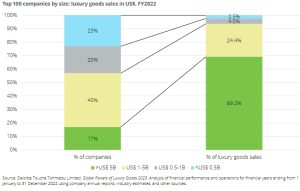

During FY2022 the Top 100 luxury goods companies generated composite sales of US$347 billion, up from the US$305 billion registered in FY2021. This sharp increase in luxury goods sales signals the good state of the luxury industry after the COVID-19 pandemic years.

Luxury goods companies continue their process of moving toward an environmentally responsible, circular economy business

model, pushed by customer demand and increasing regulations. In this phase of change, technology can help accelerate the

green transition while improving the relationship between companies and their customers. Several recent developments

in digital technology, including artificial intelligence (AI), machine learning, and the Internet of Things (IoT), may change the

luxury market forever.

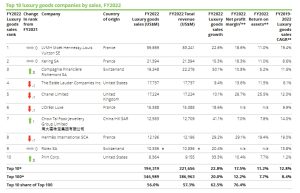

The report presents the Top 100 largest luxury goods companies globally, based on their consolidated luxury goods sales in FY2022,

which we define as financial years ending within the 12 months from 1 January to 31 December 2022.

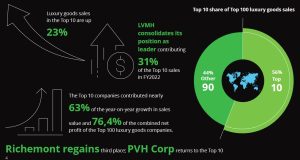

In FY2022, personal luxury goods sales for the Top 10 luxury companies increased by 22.8%. However, the share of their sales in the

combined luxury goods sales of the Top 100 companies showed little change—it decreased by only 0.2 percentage points to 56.0%.

Companies registered double-digit sales growth in all product sectors, in particular fashion sector returned to growth with the

strongest recovery in FY2022.

Luxury goods sales of the Top 100 companies across all countries considered in this report increased by double digits in FY2022.

France confirms its leadership in luxury with seven companies that accounted for nearly one-third of the Top 100 luxury goods sales.

Game changing steps in luxury

Luxury goods companies play an important role in moving the broader fashion industry toward an environmentally responsible, circular economy. Technology can help accelerate the green transition and improve the relationship between companies and their customers. Several recent developments in digital technology, including artificial intelligence (AI), machine learning, and the Internet of Things (IoT), may change the luxury market forever.

The Luxury industry embraces Artificial Intelligence (AI)

The Luxury industry is synonymous with exclusivity, craftsmanship, and innovation. It has thrived for decades by catering to a discerning clientele seeking distinctive and personalized experiences. However, it has been affected by technological advancements and innovation.

With the omnichannel revolution, digital IDs, and the metaverse incursion, Luxury has been among the industries experimenting most with technology and digitization in recent years.

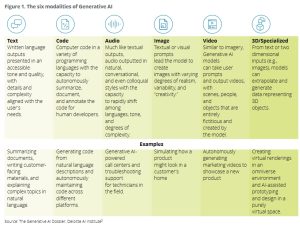

In the business world, AI and generative AI (GenAI) are becoming increasingly important and exciting tools for enhancing customer service, simplifying repetitive tasks, and improving productivity. Even though AI has been around since the 1950s, the popularity of this technology has risen since the emergence of GenAI. Global revenue from GenAI technology is expected to reach US$36 billion by 2028, a compound annual growth rate (CAGR) of 58% from 2023 to 2028.

GenAI can create new ideas and content, including conversations, stories, images, videos and music that appear to be generated by humans. Content ranges from business insights to creativity and productivity. GenAI relies on machine learning models (algorithms trained on large amounts of data) as does any other form of AI.

We hope you find this report interesting and useful, and welcome your feedback.

Giovanni Faccioli, Fashion & Luxury industry global colead, Deloitte Italy

Karla Martin, Fashion & Luxury industry global colead, Deloitte US

Ida Palombella, Fashion and Luxury industry, global colead, Deloitte Italy

More: Deloitts